For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.2810.

In economic news, the Euro-zone’s consumer price index (CPI) rose 0.4% on a MoM basis in September, at par with market expectations and compared to a gain of 0.1% registered in August. Meanwhile, the region’s seasonally adjusted trade surplus widened to €15.8 billion from a revised trade surplus of €12.7 billion registered in the prior month. Markets were expecting the nation’s trade surplus to expand to €13.3 billion.

Elsewhere, Italy global trade surplus dropped to €2.06 billion in August.

The US Dollar traded on a higher footing after the initial unemployment claims in the US surprisingly fell to 264,000 in the week ended October 11, marking its lowest level in 14-years, beating market expectations for a rise to 290,000 and compared to a number of 287,000 reported in the previous week. However, the nations continuing claims unexpectedly climbed to 2389.0 K, higher than market expectations to ease to a level of 2380.0 K in the week ended October 4. Meanwhile, industrial production in the US rose 1.0% on a monthly basis in September, beating market expectations for an increase of 0.4% and compared to a revised drop of 0.2% in the previous month, while manufacturing production climbed 0.5% on a monthly basis, exceeding market forecasts in the same month. Additionally, the nation’s diffusion index of current activity advanced to a level of 20.7 in October, after registering a reading of 22.5 in September. Markets were expecting it to ease to a level of 20.0. On the other hand, the NAHB housing market index unexpectedly fell to 54.0 in October, down from previous month’s level of 59.0 and compared to market expectations of an unchanged reading.

Separately, the St Louis Fed President, James Bullard opined that the Fed should maintain the size of its asset purchase programme unchanged at its next policy meeting, citing his worries about a recent drop in the nation’s inflation expectations.

The Minneapolis Fed President, Narayana Kocherlakota, reiterated that any interest rates hike in 2015 would be inappropriate, amid concerns about muted inflation outlook. Further he added that the US central bank could do more to help US citizens struggling with unemployment or under-employment.

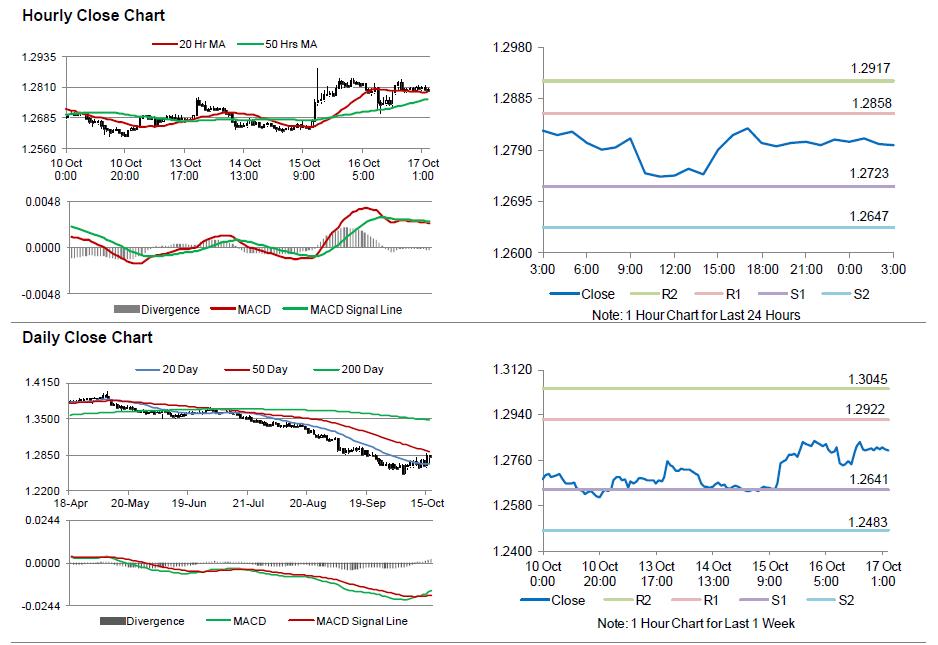

In the Asian session, at GMT0300, the pair is trading at 1.2799, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.2723, and a fall through could take it to the next support level of 1.2647. The pair is expected to find its first resistance at 1.2858, and a rise through could take it to the next resistance level of 1.2917.

Meanwhile, investors await Michigan’s consumer confidence and housing starts data from the US, as well as the Fed Chief, Janet Yellen’s speech, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.