For the 24 hours to 23:00 GMT, the EUR rose marginally higher against the USD and closed at 1.0845.On the macro front, the Euro-zone’s Sentix investor confidence index advanced to its highest level of 18.6 since August 2007 in March, beating market expectations of a rise to a level of 15.0 and following a level of 12.4 in the previous month, thus easing concerns over the outlook of the single-currency region’s economy.

In other economic news, Germany’s trade surplus surprisingly narrowed to €15.9 billion in January, lower than market expectations for an increase to €19.5 billion. Also, the nation’s current account surplus edged down to €16.8 billion, following previous month’s revised level of €25.6 billion.

Yesterday, the Deutsche Bundesbank President, Jens Weidmann opined that the risks of inflation being too low does not justify the quantitative easing program adopted by the ECB. He also stated the central bank should be aware of the risks associated with too long a phase of too low inflation rates.

Meanwhile, the ECB commenced its €60 billion a month bond buying program yesterday. Additionally, the EU ministers indicated that Greece fell “far short,” with the reform measures it revealed to a group of Europe’s finance ministers two weeks ago.

In the US, the Cleveland Fed President, Loretta Mester reiterated her belief that the US central bank was on the path of a hike in interest rate in near future. Further, she noted that both the rate hike and the direction of monetary policy will be based on the nation’s progress towards the central bank’s target of maximum employment and price stability.

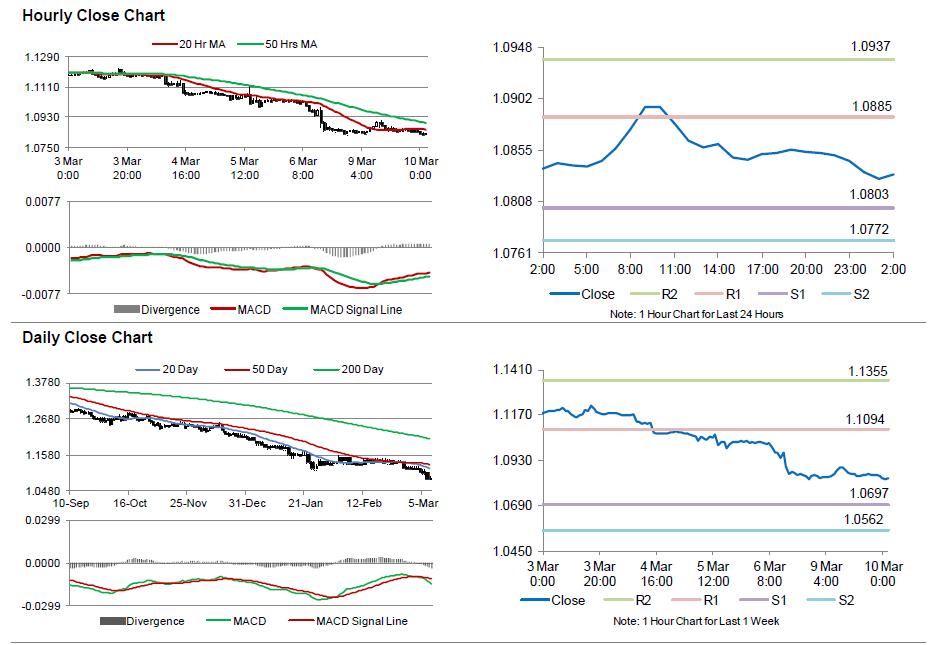

In the Asian session, at GMT0400, the pair is trading at 1.0833, with the EUR trading 0.11% lower from yesterday’s close.

The pair is expected to find support at 1.0803, and a fall through could take it to the next support level of 1.0772. The pair is expected to find its first resistance at 1.0885, and a rise through could take it to the next resistance level of 1.0937.

Amid a light economic calendar in the Euro-zone today, investor sentiment would be determined by global macroeconomic news.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.