For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.0632 on Friday.

Macroeconomic data indicated that the US flash Reuters/Michigan consumer sentiment index dropped more-than-anticipated to a level of 95.7 in February, after hitting a thirteen-year high level of 98.5 in the prior month and compared to market expectations of a drop to a level of 98.0. On the other hand, the nation posted a higher-than-expected budget surplus of $51.3 billion in January, after recording a deficit of $27.5 billion in the prior month.

Separately, over the weekend, the US Federal Reserve (Fed) Vice Chairman, Stanley Fischer, noted that there was significant uncertainty about the US President, Donald Trump’s planned fiscal policies, but the Fed is focused in meeting its dual mandate of creating full employment and getting inflation to 2.0%.

In the Asian session, at GMT0400, the pair is trading at 1.0617, with the EUR trading 0.14% lower against the USD from Friday’s close.

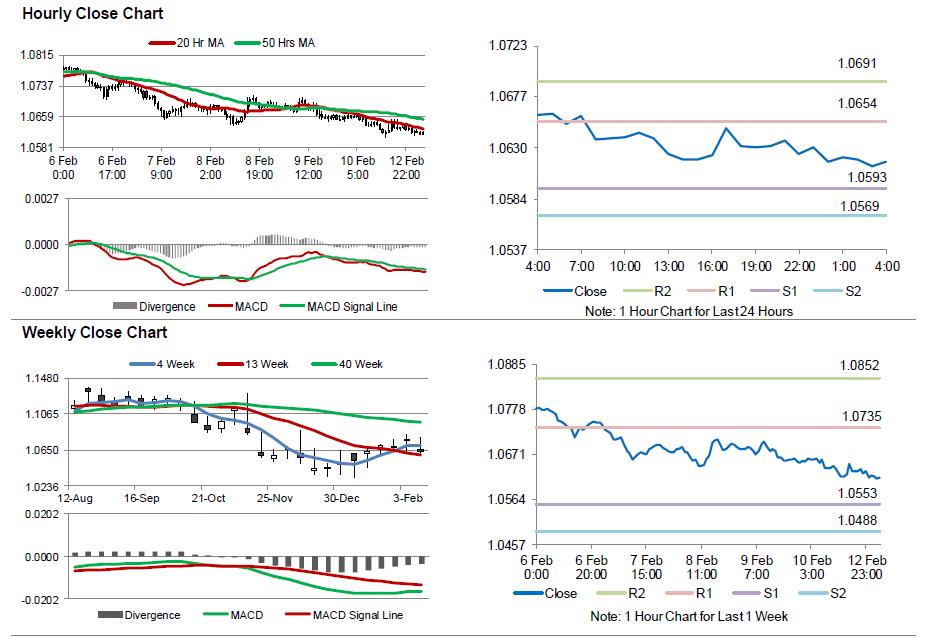

The pair is expected to find support at 1.0593, and a fall through could take it to the next support level of 1.0569. The pair is expected to find its first resistance at 1.0654, and a rise through could take it to the next resistance level of 1.0691.

Going ahead, investors will focus on the European Commission’s economic forecast and German Buba monthly report, both scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.