For the 24 hours to 23:00 GMT, EUR retreated marginally against the USD and closed at 1.2770.

Fitch Ratings agency stated that there is a “significant chance” that Italy would have its credit rating downgraded at the end of this month because there is no credible financial firewall in Europe. Further the rating agency stated that it does not expect to cut France’s triple-A credit rating this year.

Meanwhile, in economic news, the Bank of France indicated that its business sentiment indicator for manufacturers climbed to 96.0, from 95.0 in November. Also, industrial production in France advanced 1.1% (MoM) in November.

In the Asian session, at GMT0400, the pair is trading at 1.2742, with the EUR trading 0.21% lower from yesterday’s close, as investor sentiment towards the Euro was dented amid persistent worries over the debt crisis in the Euro-zone.

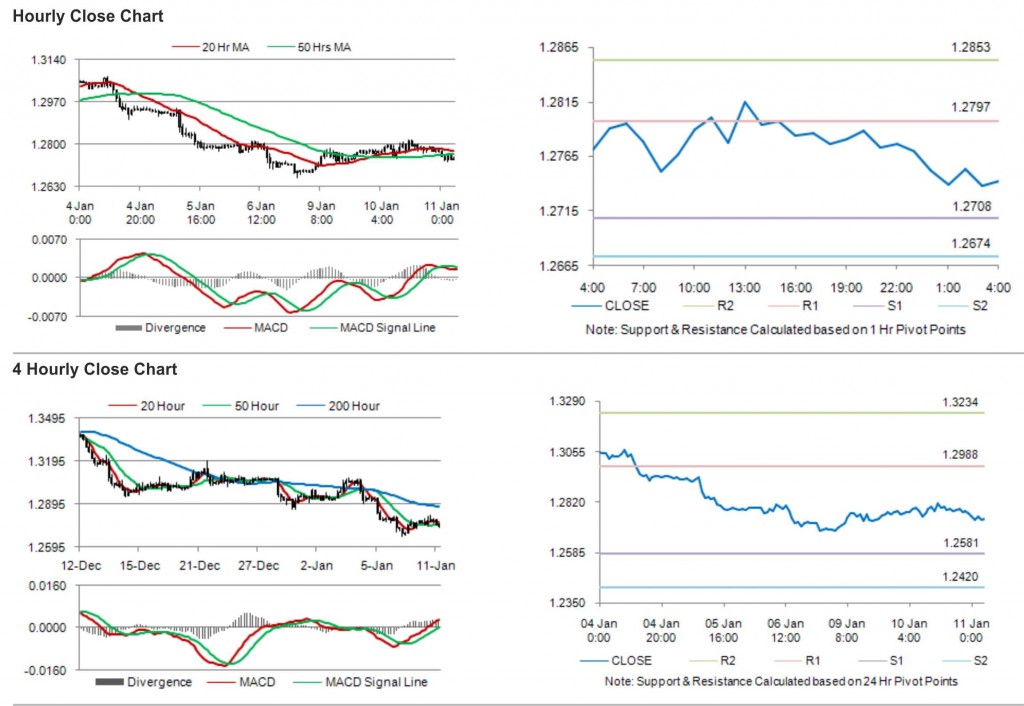

The pair is expected to find support at 1.2708, and a fall through could take it to the next support level of 1.2674. The pair is expected to find its first resistance at 1.2797, and a rise through could take it to the next resistance level of 1.2853.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.