For the 24 hours to 23:00 GMT, the EUR declined 0.29% against the USD and closed at 1.2344.

Macroeconomic data indicated that the Euro-zone’s seasonally adjusted current account surplus narrowed to €35.1 billion in February, from a revised surplus of €39.0 billion in the prior month.

Separately, first time claims for the US unemployment benefits slightly eased to a level of 232.0K in the week ended 14 April, compared to market expectations for a fall to a level of 230.0K. In the previous week, initial jobless claims had recorded a level of 233.0K. Additionally, the nation’s Philadelphia Fed manufacturing index unexpectedly rose to a level of 23.2 in April, defying market expectations for a fall to a level of 21.0. In the previous month, index had recorded a reading of 22.3. Moreover, the nation’s leading indicator grew 0.3% on a monthly basis in March, meeting market expectations and following a revised rise of 0.7% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2337, with the EUR trading 0.06% lower against the USD from yesterday’s close.

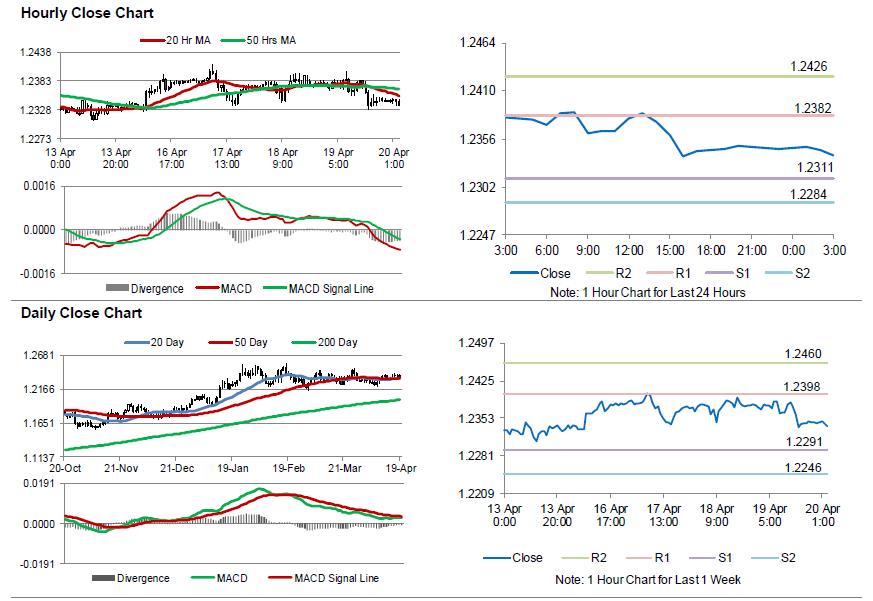

The pair is expected to find support at 1.2311, and a fall through could take it to the next support level of 1.2284. The pair is expected to find its first resistance at 1.2382, and a rise through could take it to the next resistance level of 1.2426.

Ahead in the day, market participants would focus on the Euro-zone’s flash consumer confidence index for April as well as Germany’s producer price index for March.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.