For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.3602, as the latter came under pressure from a higher-than-expected 1.0% drop in the US Q1 GDP data which signalled a contraction for the first time in three years. However, the number of people claiming jobless benefits in the world’s largest economy declined by 27,000 to a seasonally adjusted 300,000 for the week ended 24 May 2014 while continuing jobless claims fell to 2.63 million in the week ended 17 May, the lowest level since November 2007. Separately, data showed that the US pending home sales index advanced 0.4% (MoM) in April.

Late Thursday, the Kansas City Fed President, Esther George, urged the US central bank to start raising its interest rates soon after it winds down its QE programme to minimise risks in the nation’s financial system.

Meanwhile, in the Euro-zone, reports from Italy showed that the Rome-based Treasury successfully auctioned its 10-year bonds, yesterday, at 3.01%, the lowest yield on record while a separate official report from Spain confirmed that the Euro-zone’s fourth-largest economy expanded 0.4% (QoQ) in the first quarter of 2014, in-line with preliminary estimates.

In the Asian session, at GMT0300, the pair is trading at 1.3605, with the EUR trading a tad higher from yesterday’s close.

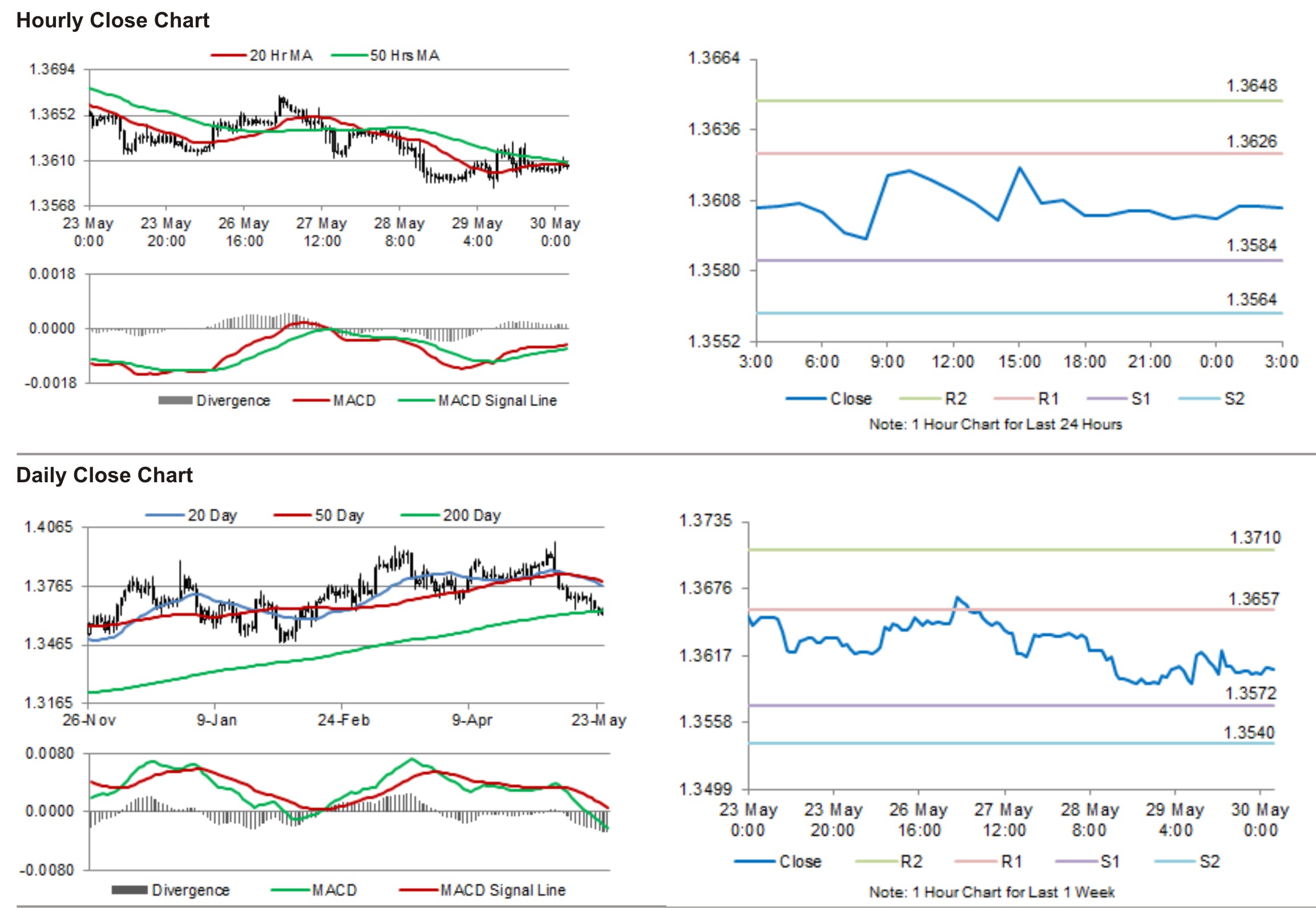

The pair is expected to find support at 1.3584, and a fall through could take it to the next support level of 1.3564. The pair is expected to find its first resistance at 1.3626, and a rise through could take it to the next resistance level of 1.3648.

Traders are expected to keep a close tab on German retail sales and Italy’s consumer and producer price data, for further cues in the Euro.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.