For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.0907.

On the economic front, French consumer confidence index remained steady at a level of 100.0 in April, meeting market expectations.

In the US, data revealed that MBA mortgage applications rebounded 2.7% in the week ended 21 April 2017, following a drop of 1.8% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.0910, with the EUR trading slightly higher against the USD from yesterday’s close.

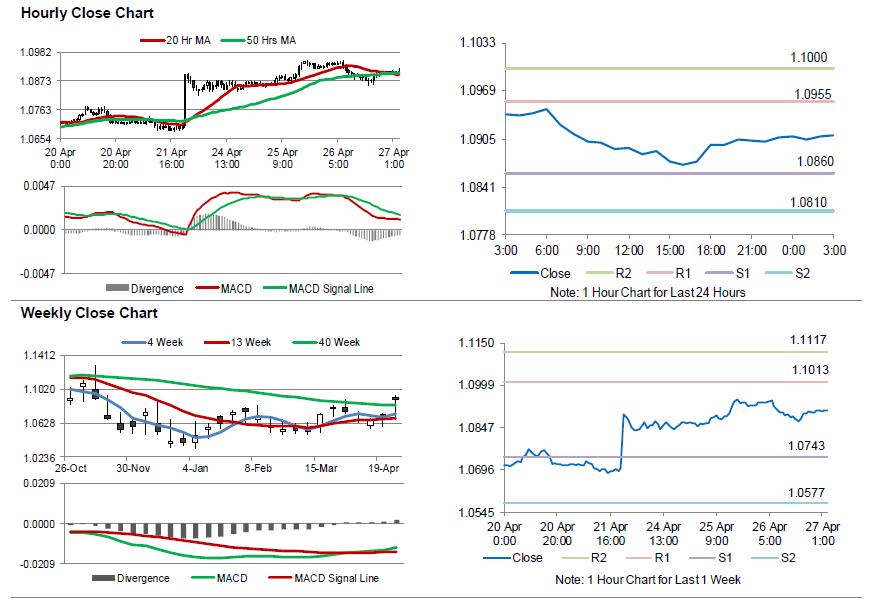

The pair is expected to find support at 1.0860, and a fall through could take it to the next support level of 1.0810. The pair is expected to find its first resistance at 1.0955, and a rise through could take it to the next resistance level of 1.1000.

Going ahead, all eyes will be on the European Central Bank’s (ECB) interest rate decision, scheduled to be announced later today. Also, the Euro-zone’s final consumer confidence index and Germany’s flash consumer price inflation, both for April, will be on investors’ radar. Moreover, the US advance goods trade balance, durable goods orders and pending home sales data, all for March coupled with weekly jobless claims data, slated to release later in the day, will garner a significant amount of market attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.