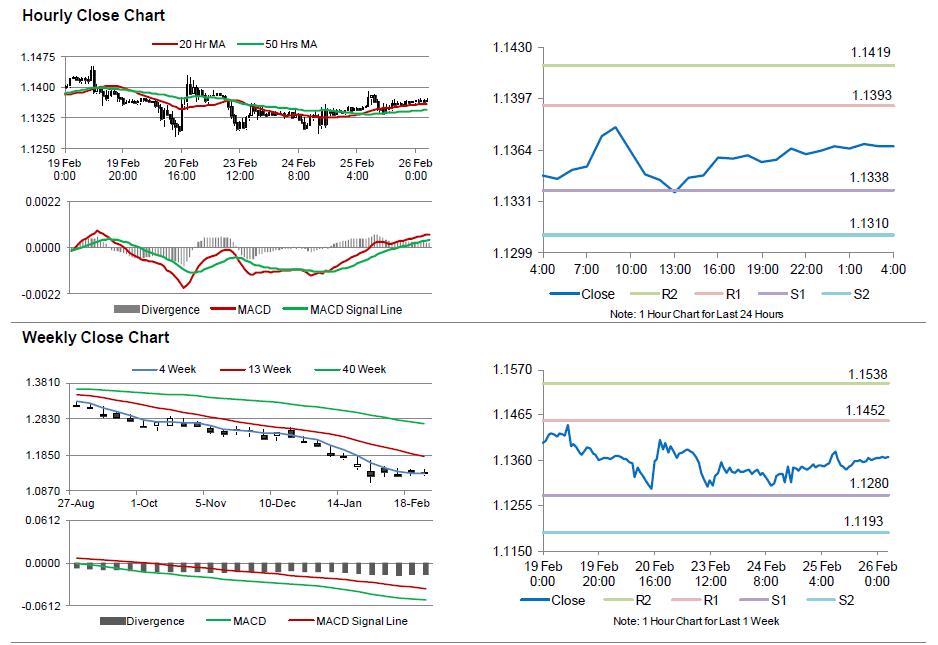

For the 24 hours to 23:00 GMT, the EUR rose 0.22% against the USD and closed at 1.1364.

Yesterday, the ECB President, Mario Draghi, in his testimony to the European Parliament in Brussels, stated that the central bank was willing to accept Greek bonds for funding, once it was convinced that the debt laden nation was on track to successfully complete its bailout program.

The greenback lost ground, after the Fed Chairperson, Janet Yellen in her testimony before the Senate banking committee, reiterated that the central bank would not raise its benchmark rate before it found confidence in the US economic recovery.

In other economic news, the US home sales dropped 0.20% to a level of 481.00 K on a monthly basis in January, higher than market expectations of 470.00 K. New home sales in the nation had recorded a revised level of 482.00 K in the prior month. Meanwhile, MBA mortgage applications fell 3.5% in the week ended February 20, compared to a drop of 13.2% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.1367, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.1338, and a fall through could take it to the next support level of 1.1310. The pair is expected to find its first resistance at 1.1393, and a rise through could take it to the next resistance level of 1.1419.

Trading trends in the Euro today are expected to be determined by Germany’s crucial unemployment rate coupled with GfK consumer confidence data, scheduled in a few hours. Additionally, the US CPI and durable goods orders data would keep investors on their toes, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.