For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.0903, as the services sector across the Euro-zone continued to expand.

Data showed that the Euro-zone’s services PMI advanced more than expected to a reading of 54.0 in July, following a level of 53.8 in June. Additionally, the German services PMI also edged up to 53.8 in July, from 53.7 recorded in the preceding month.

Gains in the common-currency were kept in check, after the retail sales in the Euro-zone retreated more than expected by 0.6% MoM in June, following a revised gain of 0.1% in May.

In the US, the ISM non-manufacturing index rallied to a ten-year high level of 60.3 in July, from prior month’s reading of 56.0 and beating market expectations of 56.2 points. The nation’s services sector expansion was led by sharp increases in business activity, employment and new orders, thereby strengthening the case for an interest rate hike by the Fed at its next meeting in September.

On the other hand, the ADP private sector employment figure rose by 185.0 K in July, lower than market expectations of an advance of 210.0 K and compared to prior month’s revised increase of 229.0 K. Meanwhile, the US trade deficit widened more than expected to $43.80 billion in June, compared to previous month’s deficit of $40.9 billion.

Separately, the Fed Governor, Jerome Powell advocated a wait and watch approach regarding interest rate hike in September till further economic data releases.

In the Asian session, at GMT0300, the pair is trading at 1.0907, with the EUR trading a tad higher from yesterday’s close.

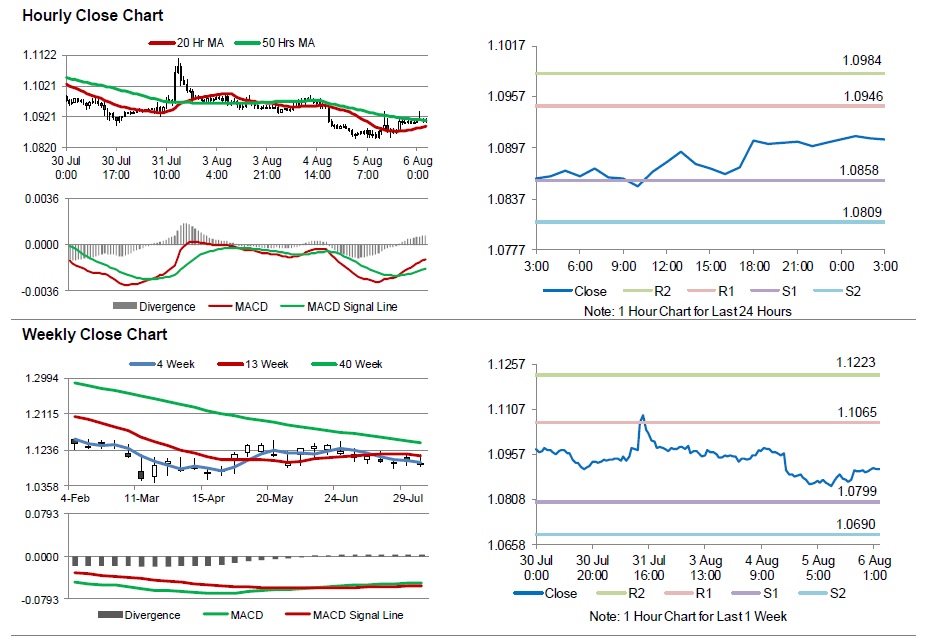

The pair is expected to find support at 1.0858, and a fall through could take it to the next support level of 1.0809. The pair is expected to find its first resistance at 1.0946, and a rise through could take it to the next resistance level of 1.0984.

Trading trends in the Euro today are expected to be determined by Germany’s factory orders data, scheduled in a few hours. Additionally, investors keenly await initial jobless claims data from the US, scheduled to release ahead in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.