For the 24 hours to 23:00 GMT, the EUR declined 0.33% against the USD and closed at 1.1365.

In economic news, consumer confidence index in the Euro-zone improved to a level of -6.70 in February, compared to a level of -8.50 in the previous month. Markets were anticipating the index to advance to -7.50. Meanwhile, the region’s seasonally adjusted current account surplus fell to €17.8 billion in December, following a level of €19.9 billion in November.

Yesterday, the ECB released the minutes of its monetary policy meeting for the first time ever. The minutes revealed that ECB’s Peter Praet cautioned members of the dire consequences of delaying the introduction of quantitative easing. Additionally, the minutes further indicated that the Fears of continued deflation in the region led the central bank to introduce its controversial quantitative easing program in January.

The greenback traded on a stronger footing after initial jobless claims in the US dropped more than expected to a level of 283.0 K, against market expectations of 290.0 K in the week ended 14 February. Meanwhile, leading indicator climbed 0.20% in January, compared to a revised advance of 0.40% in the previous month. Markets were anticipating leading indicator to rise 0.30%.

In other economic news, the Philadelphia Fed manufacturing index registered an unexpected drop to a level of 5.20 in February, lower than market expectations of an advance to a level of 9.00.

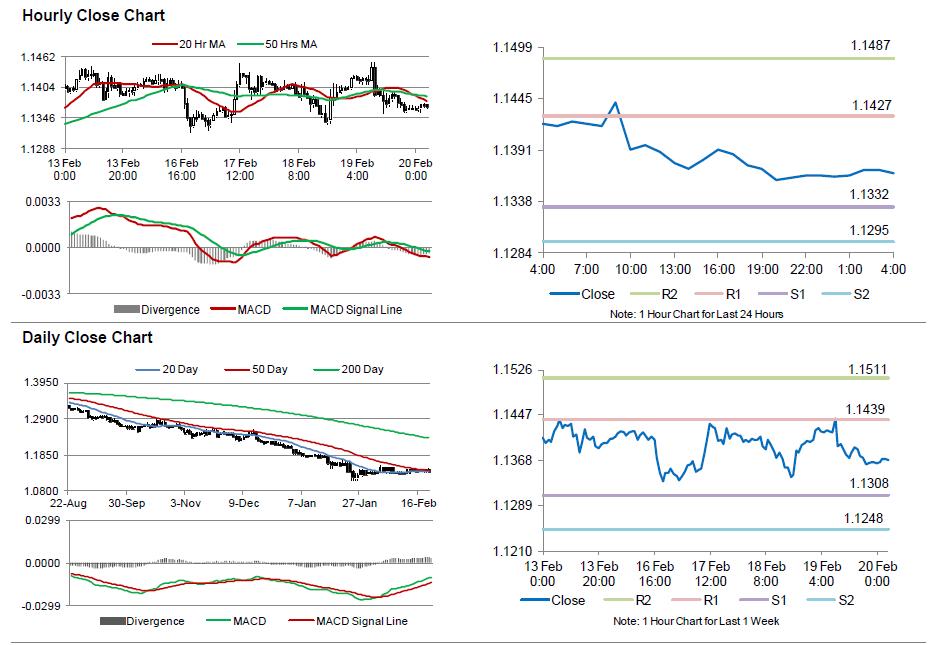

In the Asian session, at GMT0400, the pair is trading at 1.1368, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.1332, and a fall through could take it to the next support level of 1.1295. The pair is expected to find its first resistance at 1.1427, and a rise through could take it to the next resistance level of 1.1487.

Trading trends in the Euro today are expected to be determined by the market and services PMI data from the Euro-zone and its peripheries, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.