For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.3548. The greenback advanced on the back of upbeat US consumer inflation data. Official data showed that annual consumer inflation rate in the US advanced more than market expectations to 2.1% in May, its largest 12-month increase since October 2012. However, US housing starts fell 6.5% to 1,001,000 in May for the first time in four months while application for building permits in the US economy declined 6.4% to an annual rate of 991,000, last month.

Meanwhile, in the Euro-zone, an ECB policymaker, Luis Maria Linde opined that, despite the central bank’s recent policy actions to support the Euro-zone economy, recovery in the Euro-bloc still remained fragile with persistent fragmentation in its financial markets. Separately, the IMF, in a report, highlighted the need for the Italian government to take quick policy actions to spur growth and cut debt in its economy as, according to the organisation, Italy’s economic recovery still remained fragile.

In other economic news, German ZEW economic sentiment deteriorated for the sixth consecutive month to reach an 18-month low level of 29.8 in June while ZEW’s index on current economic situation in Germany rose by 5.6 points to a level of 67.7, the highest since July 2011. However, ZEW’s survey on current economic situation in the Euro-zone decreased by 2.1 points while its expectations index for the Euro-bloc gained 3.2 points to 58.4 in June.

In the Asian session, at GMT0300, the pair is trading at 1.3546, with the EUR trading a tad lower from yesterday’s close.

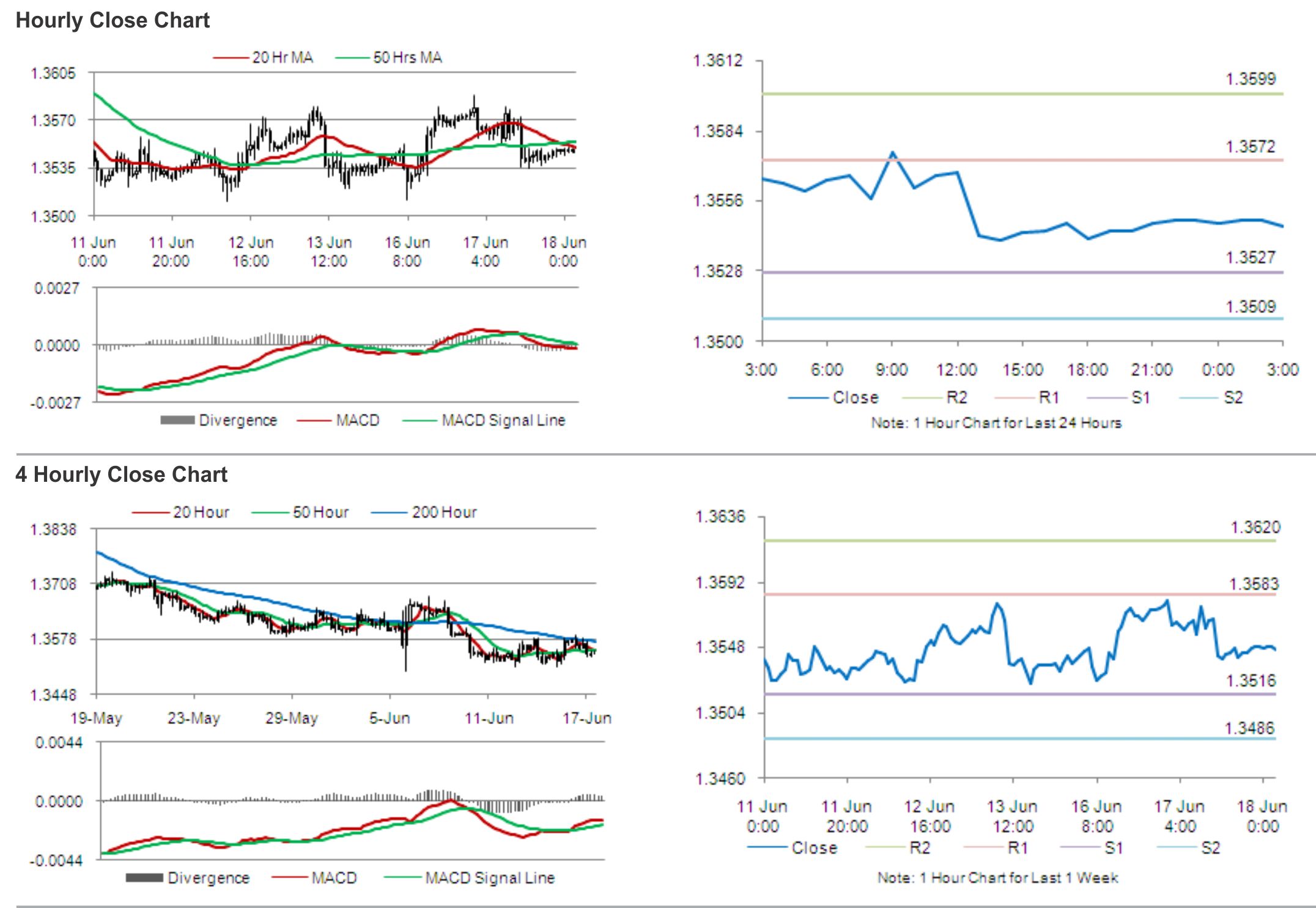

The pair is expected to find support at 1.3527, and a fall through could take it to the next support level of 1.3509. The pair is expected to find its first resistance at 1.3572, and a rise through could take it to the next resistance level of 1.3599.

Market participants keenly await the outcome of Fed’s two day policy meeting in June, along with the Euro-zone’s construction output data, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.