For the 24 hours to 23:00 GMT, EUR rose 0.25% against the USD and closed at 1.3630. The US Dollar gave up ground against the Euro after a report from the US showed that the ISM non-manufacturing PMI in the nation unexpectedly declined to a reading of 53.0 in December, from a level of 53.9 recorded in November. Market had expected the index to advance to a reading of 54.6 in December.

In economic news, an official report revealed that Germany’s consumer inflation rate rose to 1.4% (YoY) in December, in-line with market estimates and compared to a level of 1.3% recorded in the previous month. Meanwhile, Markit Economics reported that Euro-zone’s service sector PMI edged down to a reading of 51.0, at par with analysts’ estimates, and compared to a level of 51.2 registered in the preceding month. The institute also reported a rise in the Euro-zone’s composite PMI to a reading of 52.1 in December, from the previous month’s level of 51.7. Separately, another report showed that the Sentix investor confidence in the Euro-zone economy rose to a reading of 11.9 in January, way above market expectations for a rise to 9.5, from a figure of 8.0 recorded in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.3627, with the EUR trading tad lower from yesterday’s close. Earlier today, the US Senate Committee voted 56-26 to approve President, Barack Obama’s nominee, Janet Yellen as the first Chairwoman of the Fed.

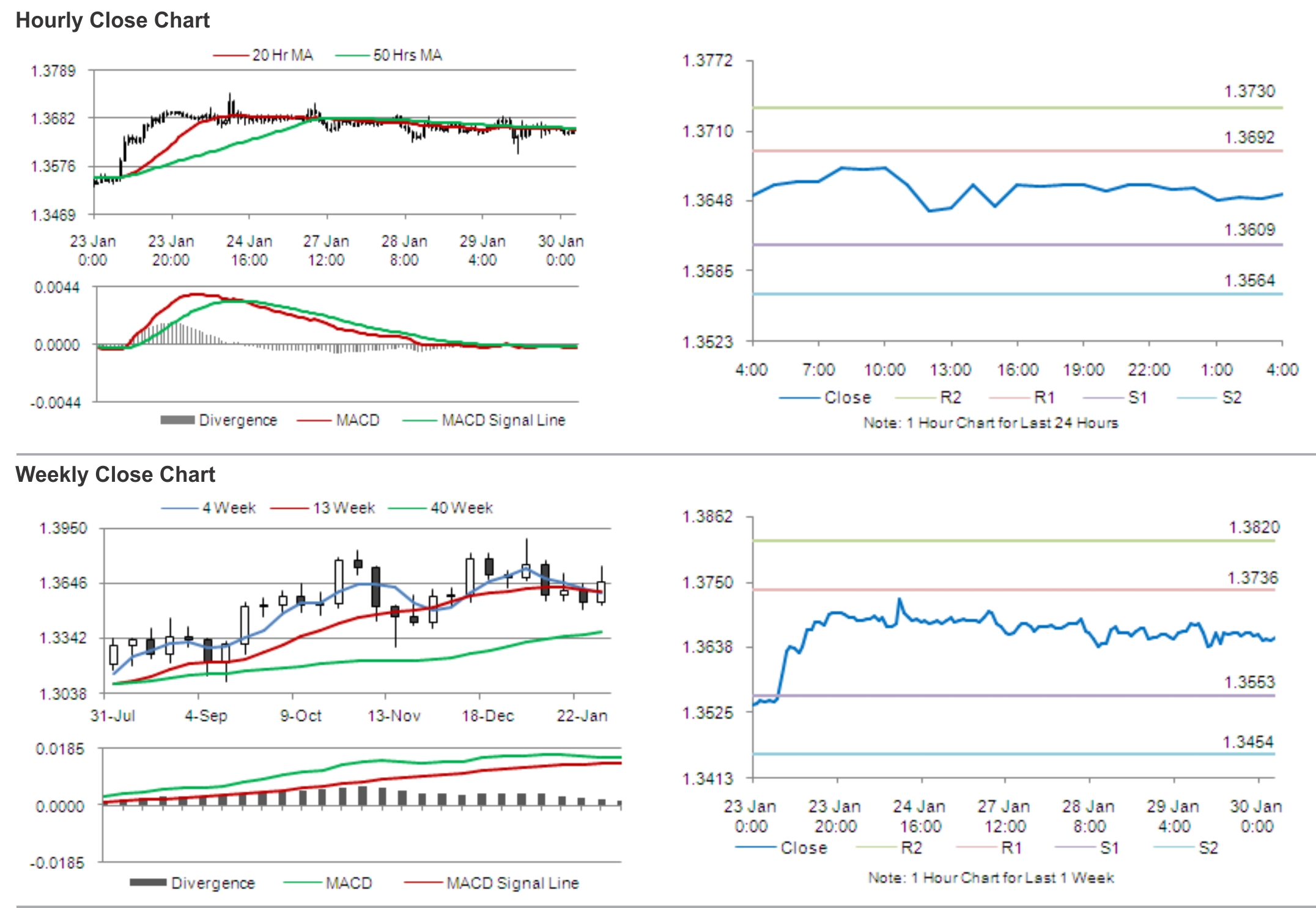

The pair is expected to find support at 1.3581, and a fall through could take it to the next support level of 1.3534. The pair is expected to find its first resistance at 1.3664, and a rise through could take it to the next resistance level of 1.3700.

Later today, the German Statistics Office is set to release its reading on the nation’s unemployment rate, ahead of the release of Euro-zone’s consumer price index data.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.