For the 24 hours to 23:00 GMT, the EUR declined 0.33% against the USD and closed at 1.0786, on the back of downbeat German factory orders data.

Data showed that German factory orders unexpectedly fell 0.9% MoM in February, compared to market expected rise of 1.5% and following a 2.6% drop recorded in the preceding month.

In other economic news, retail sales in the Euro-zone retreated 0.2% on a monthly basis in February. It had risen 0.9% in the previous month.

In the US, the recently released Federal Open Market Committee (FOMC) minutes indicated that some policy makers suggested that the economic data and outlook warrant a rate hike in June this year, while other Fed officials argued for a rate increase later in the year stating that a decline in energy prices and a strong dollar would continue to curb inflation.

Separately, the New York Fed President, William Dudley hinted that with payroll growth in the US remaining above trend for the past few months and outpacing the economy’s recovery pace, a surprise fall in March’s payroll numbers were less alarming.

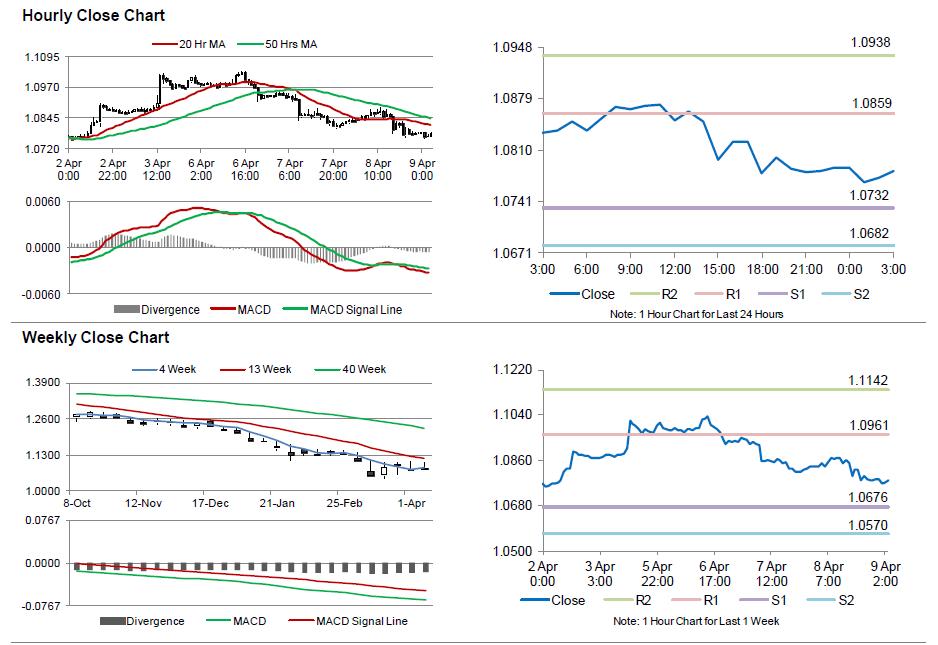

In the Asian session, at GMT0300, the pair is trading at 1.0781, with the EUR trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.0732, and a fall through could take it to the next support level of 1.0682. The pair is expected to find its first resistance at 1.0859, and a rise through could take it to the next resistance level of 1.0938.

Trading trends in the Euro today are expected to be determined by Germany’s industrial production coupled with the nation’s trade balance data, scheduled in a few hours. Meanwhile, US initial jobless claims data would be closely watched by market participants, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.