For the 24 hours to 23:00 GMT, the EUR rose 1.16% against the USD and closed at 1.1469.

In economic news, the Euro-zone’s producer price index fell 1.0% on a MoM basis in December, compared to a drop of 0.3% in the previous month. Market anticipations were for the index PPI to fall 0.7%.

In the US, factory orders fell 3.4% on a monthly basis, more than market expectations for a drop of 2.4%. In the previous month, factory orders had fallen by a revised 1.7%. Meanwhile, the seasonally adjusted Redbook index eased 3.5% on a MoM basis, in the week ended 30 January 2015. In the prior week, the index had registered a drop of 3.6%.

Separately, the St. Louis Fed President, James Bullard reinforced his view that the Fed should raise interest rates in the US sooner rather than later and then adopt a gradual approach for further interest rate hikes. Furthermore, he urged the central to remove the word “patient” from its next policy statement as it would give more flexibility on the timings of interest rates hikes.

In the Asian session, at GMT0400, the pair is trading at 1.1466, with the EUR trading a tad lower from yesterday’s close.

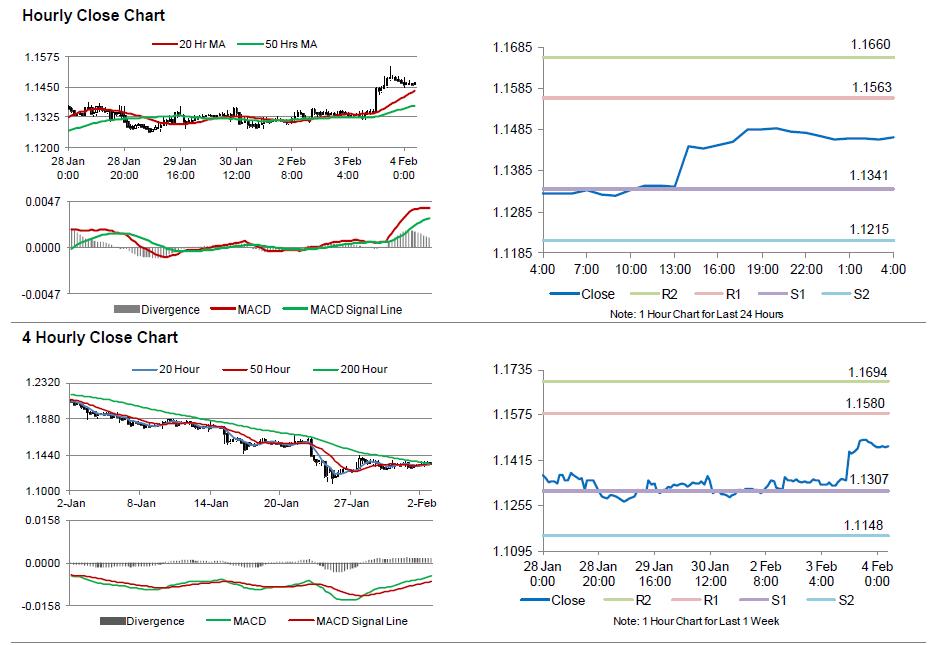

The pair is expected to find support at 1.1341, and a fall through could take it to the next support level of 1.1215. The pair is expected to find its first resistance at 1.1563, and a rise through could take it to the next resistance level of 1.1660.

Trading trends in the Euro today are expected to be determined by the services PMI data from the Euro-zone and its peripheries, coupled with the region’s retail sales data, scheduled in few hours. Meanwhile, investors would also concentrate on the US ISM non-manufacturing composite data, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.