For the 24 hours to 23:00 GMT, the EUR declined 0.37% against the USD and closed at 1.1964.

On the macro front, Italy’s seasonally adjusted industrial production unexpectedly climbed 0.1% on a monthly basis in July, advancing for the third straight month and confounding market expectations for a drop of 0.3%. In the previous month, industrial production had risen 1.1%.

The US Dollar advanced against its major peers, as downgrading of Hurricane Irma from a Category 5 storm to a tropical storm helped mitigate investors’ concerns over its impact on the US economy.

In the Asian session, at GMT0300, the pair is trading at 1.1962, with the EUR trading a tad lower against the USD from yesterday’s close.

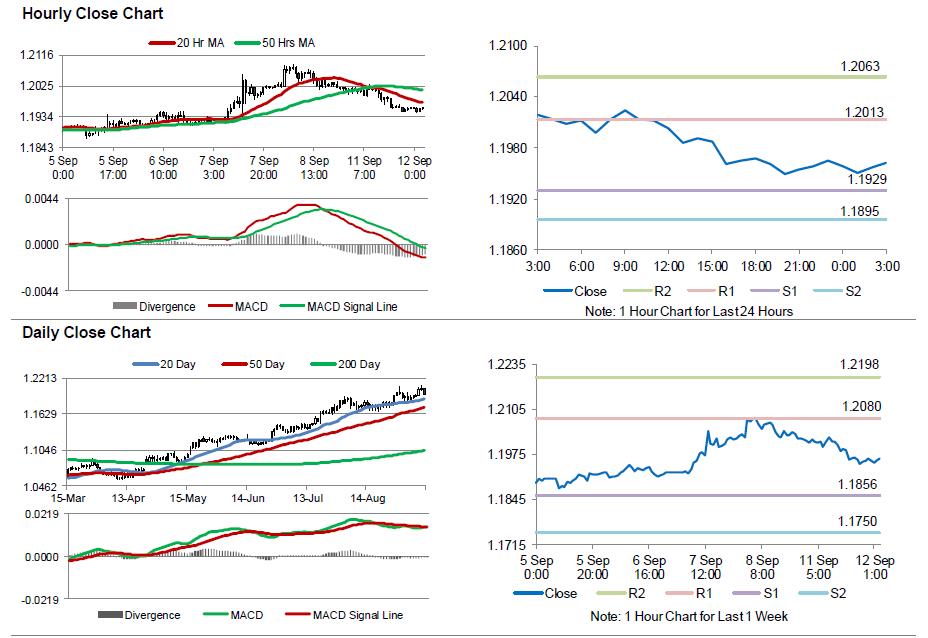

The pair is expected to find support at 1.1929, and a fall through could take it to the next support level of 1.1895. The pair is expected to find its first resistance at 1.2013, and a rise through could take it to the next resistance level of 1.2063.

Amid a lack of macroeconomic releases in the Euro-zone today, investors will look forward to the release of the US NFIB small business optimism index for August, slated in a few hours along with the nation’s JOLTs job openings for July, due later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.