For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.2157.

In economic news, the ECB reported that M3 money supply rose 3.10% on an annual basis in November, higher than market expectations for a rise of 2.60%. M3 money supply had registered a rise of 2.50% in the prior month. Meanwhile, private sector loans in the region eased 0.90% in November on an annual basis. In the previous month, private sector loans had dropped 1.10%.

Data from Italy revealed that the business confidence index in the nation came in above expectations in December, while the producer price index on monthly basis fell in November.

Additionally, Spanish retail sales advanced at the fastest rate in more than a year during November, while the consumer price index continued to deteriorate in December. Furthermore, the current account surplus in Spain rose to €0.31 billion, as compared to a revised current account surplus of €0.29 billion in the prior month.

In the US, the consumer confidence data, which is an important driver for economic growth rose to a level of 92.60, lower than market expectations of a rise to 94.00. In the prior month, the consumer confidence index had registered a revised reading of 91.00.

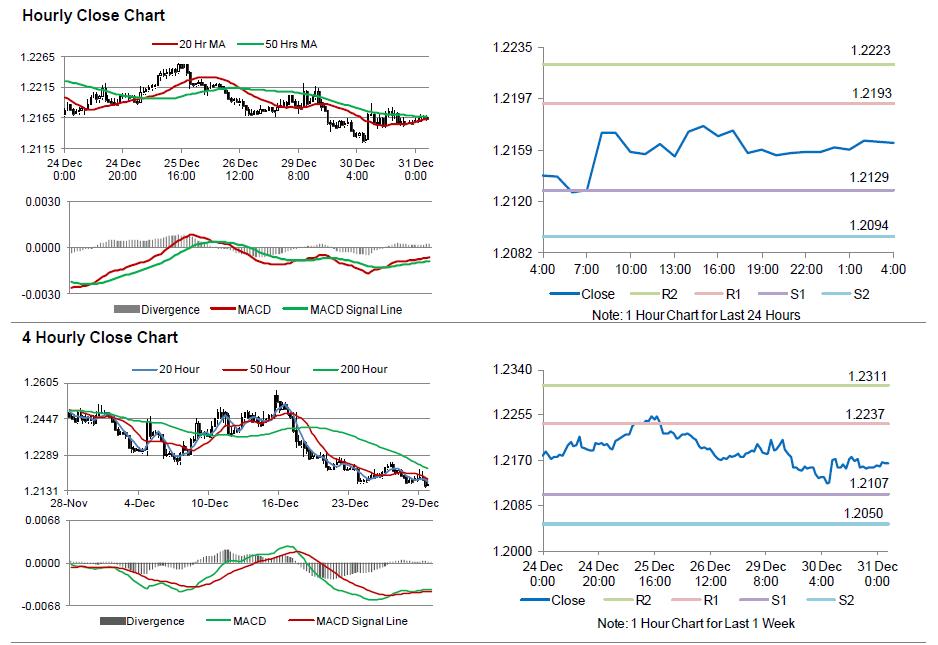

In the Asian session, at GMT0400, the pair is trading at 1.2164, with the EUR trading 0.05% higher from yesterday’s close.

The pair is expected to find support at 1.2129, and a fall through could take it to the next support level of 1.2094. The pair is expected to find its first resistance at 1.2193, and a rise through could take it to the next resistance level of 1.2223.

Trading trends in the pair today are expected to be determined by the release of weekly jobless claims data, Chicago Purchasing Managers’ Index and pending home sales data from the US, slated to release today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.