For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1772.

On the macro front, the Euro-zone’s final consumer price index (CPI) climbed 1.4% on an annual basis in October, confirming the preliminary print and pointing to subdued inflationary pressures in the common currency region. The CPI had risen 1.5% in the previous month.

The greenback advanced against most of its major counterparts, after the US House of Representatives approved its version of tax reform proposals that includes $1.5 trillion in tax cuts for businesses and individuals.

On the data front, industrial production in the US jumped more-than-expected by 0.9% on a monthly basis in October, advancing by the most since April 2017, as factory activity recovered from the impact of Hurricanes Harvey and Irma. Market had expected industrial production to rise 0.5%, after recording a revised gain of 0.4% in the previous month. Further, the nation’s manufacturing production rose 1.3% MoM in October, topping market consensus for an increase of 0.6% and following a revised rise of 0.4% in the prior month. Additionally, the nation’s NAHB housing market index unexpectedly advanced to a level of 70.0 in November, hitting its highest level in eight months and confounding market expectations for a fall to a level of 67.0. In the prior month, the index had registered a reading of 68.0.

On the contrary, the number of Americans filing for fresh jobless claims unexpectedly rose to a 6-week high level of 249.0K in the week ended 11 November, against market anticipations for a drop to a level of 235.0K. Initial jobless claims had recorded a level of 239.0K in the previous week. Moreover, the nation’s Philadelphia Fed manufacturing index fell to a level of 22.7 in November, higher than market expectations for a drop to a level of 24.6. The index had registered a reading of 27.9 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1809, with the EUR trading 0.31% higher against the USD from yesterday’s close, as the greenback declined, on reports that investigators into possible Russian interference in the US presidential election issued a subpoena to campaign officials last month for documents.

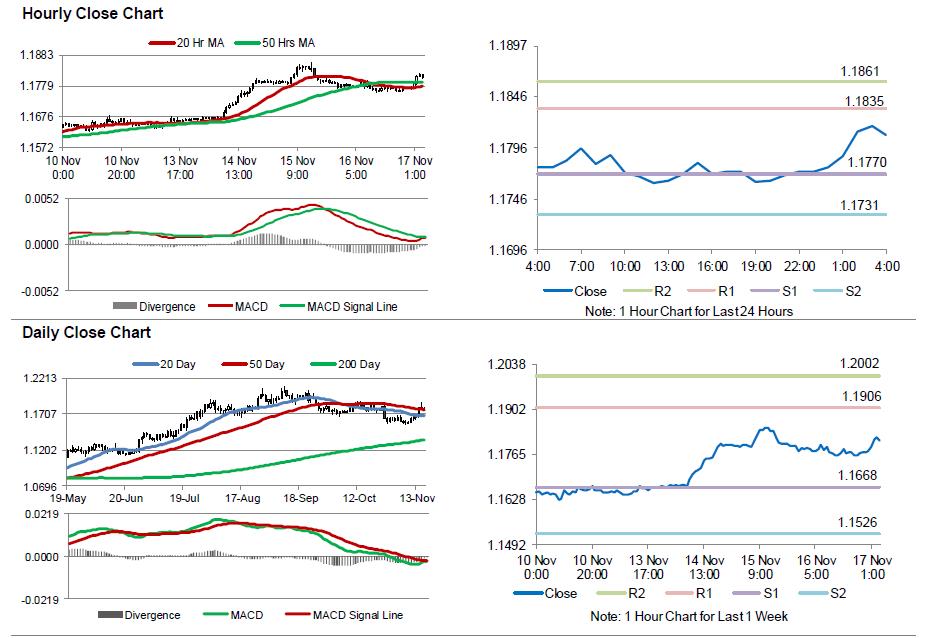

The pair is expected to find support at 1.1770, and a fall through could take it to the next support level of 1.1731. The pair is expected to find its first resistance at 1.1835, and a rise through could take it to the next resistance level of 1.1861.

Going ahead, a speech by the European Central Bank (ECB) President, Mario Draghi, scheduled in a few hours, will attract significant amount of market attention. Additionally, the US housing starts and building permits data both for October, slated to release later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.