For the 24 hours to 23:00 GMT, the EUR declined 0.81% against the USD and closed at 1.1013 extending its previous session losses.

Macroeconomic data showed that the Euro-zone’s preliminary Markit manufacturing PMI remained flat at a level of 52.0 in October, compared to market expectations of a fall to a level of 51.8. On the other hand, the services PMI rose to a level of 54.2, exceeding expectations for a reading of 53.5 and compared to last month’s reading of 53.7.

Elsewhere, in Germany, the flash markit manufacturing PMI dropped to a level of 51.6 in October, from 52.3 in the prior month, but services PMI surprisingly advanced to a reading of 55.2, from 54.1. Investors had expected a reading of 53.9. Meanwhile, the French preliminary Markit manufacturing PMI reached an 18-month high reading of 50.7 in October, from a level of 50.6 in the previous month. Investors had expected it to rise to a level of 50.2. Further, the flash services PMI rose more-than-expected to a reading of 52.3 in the same month, hitting a four-month high, from 51.9 in September.

The greenback gained ground after the flash US Markit manufacturing PMI reached a five-month high reading of 54.0 in October, compared to 53.1 in September. Market participants had expected it to fall to a level of 52.8.

In the Asian session, at GMT0400, the pair is trading at 1.1039, with the EUR trading 0.23% higher from Friday’s close.

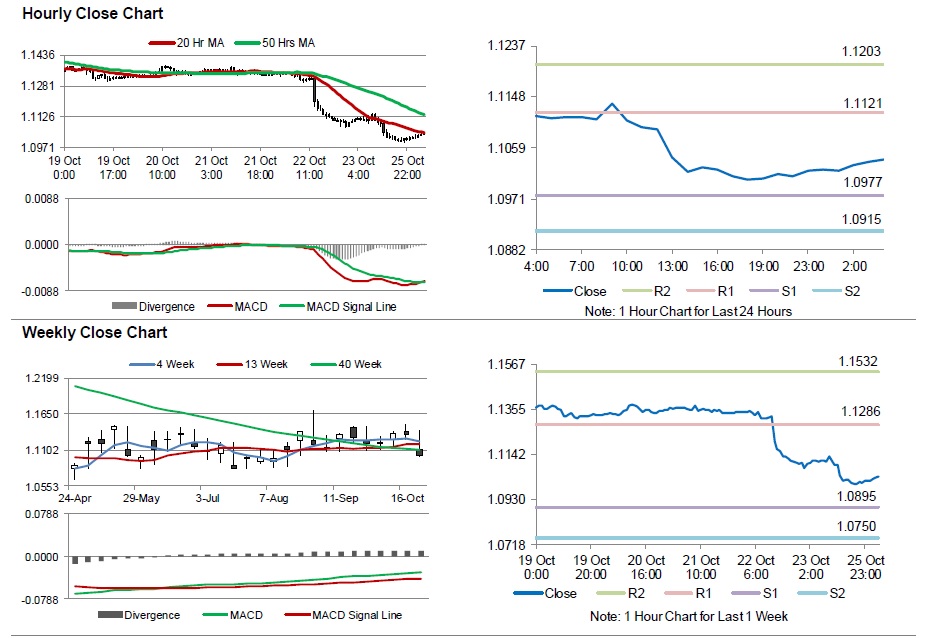

The pair is expected to find support at 1.0977, and a fall through could take it to the next support level of 1.0915. The pair is expected to find its first resistance at 1.1121, and a rise through could take it to the next resistance level of 1.1203.

Moving ahead, market participants will keep an eye on Germany’s IFO current assessment, business climate and expectations data, all for the month of October, scheduled to be released in a few hours. In addition to this, the US new home sales data for September, scheduled to be released later in the day, will also garner investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.