For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.1197.

In economic news, the Euro-zone’s Sentix investor confidence index fell more-than-expected for the second consecutive month, easing to a level of 6.0 in February, hitting its lowest level since April 2015, as the turmoil in global financial markets affected the Euro-zone. Meanwhile, markets expected it to fall to a level of 7.4, following a reading of 9.6 in the previous month.

In the US, labour market conditions index declined more-than-anticipated to a level of 0.4 in January, while markets expected it to fall to a level of 2.0 and compared to a revised reading of 2.3 in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.1213, with the EUR trading 0.14% higher from yesterday’s close.

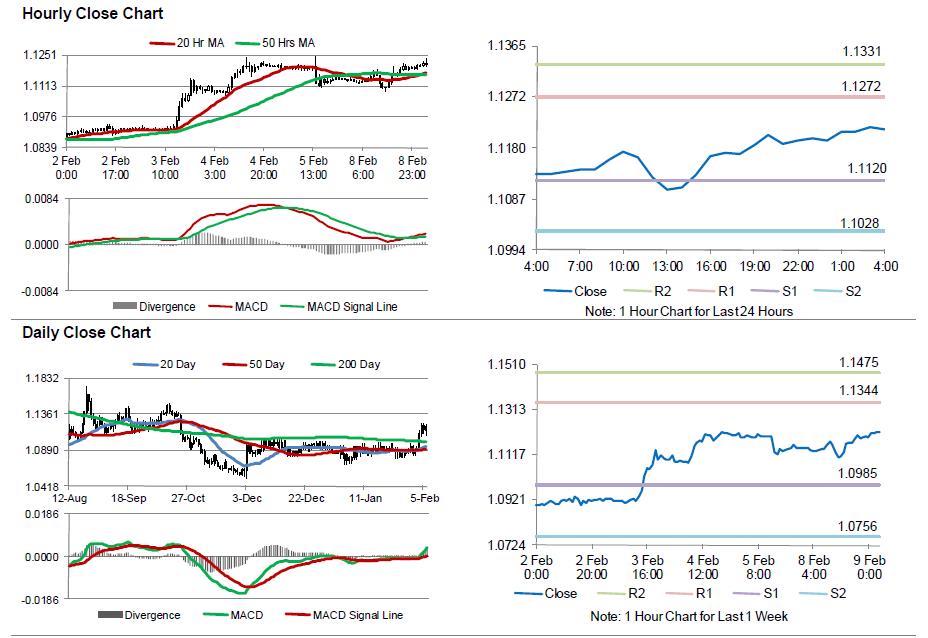

The pair is expected to find support at 1.1120, and a fall through could take it to the next support level of 1.1028. The pair is expected to find its first resistance at 1.1272, and a rise through could take it to the next resistance level of 1.1331.

Moving ahead, investors await the release of Germany’s trade balance and seasonally adjusted industrial production data, both for the month of December, scheduled to be released in a few hours. Additionally, the US NFIB small business optimism index data for January, slated to release later today, will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.