For the 24 hours to 23:00 GMT, the EUR declined 0.92% against the USD and closed at 1.1188, surrendering its earlier session gains.

In economic news, the German producer prices retreated more than expected by 0.5% on a MoM basis in August, compared to a flat reading recorded in the previous month.

In the US, existing home sales slipped 4.8% on a monthly basis in August, marking its biggest fall since January and following a downwardly revised increase of 1.8% recorded in the previous month, while markets anticipated it to drop 1.6%.

Separately, the St. Louis Fed President, James Bullard in a speech dropped hints about the possibility of an interest rate hike at the Fed’s October FOMC meeting. Further, he added that consumer prices in the nation would edge up and will eventually meet the Fed’s 2% inflation target.

In the Asian session, at GMT0300, the pair is trading at 1.1200, with the EUR trading 0.1% higher from yesterday’s close.

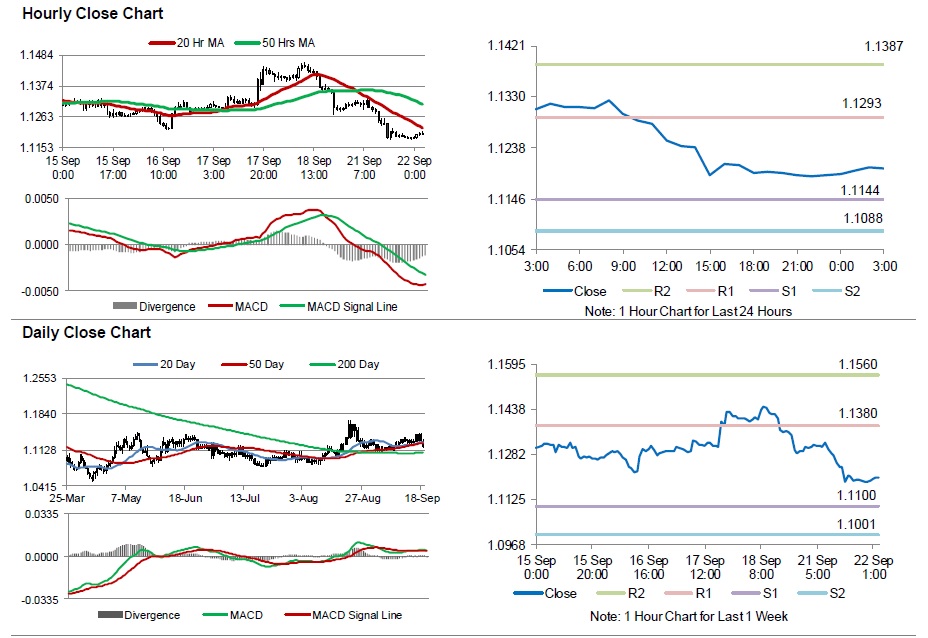

The pair is expected to find support at 1.1144, and a fall through could take it to the next support level of 1.1088. The pair is expected to find its first resistance at 1.1293, and a rise through could take it to the next resistance level of 1.1387.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer confidence data, set for release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.