For the 24 hours to 23:00 GMT, the EUR rose 0.20% against the USD and closed at 1.1352.

Macroeconomic data showed that the producer price index in Germany, Euro-zone’s largest economy, dropped more-than-expected by 0.4% MoM in September, falling for the second consecutive month, after a 0.5% decline in August. Investors had expected it to fall 0.2%. Moreover, the seasonally adjusted current account surplus in the Eurozone narrowed to €17.7 billion in August, from an upwardly revised €25.6 billion in the previous month.

In the US, housing starts rose more-than-expected by 6.5% MoM in September to an annual rate of 1.2 million, after two straight months of decline, from an upwardly revised 1.1 million in August. On the other hand, building permits unexpectedly fell 5.0% MoM in September to an annual rate of 1.1 million, its lowest since March, from 1.2 million in the previous month, thus indicating a slowdown in the country’s future home building activity.

In the Asian session, at GMT0300, the pair is trading at 1.1362, with the EUR trading marginally higher from yesterday’s close.

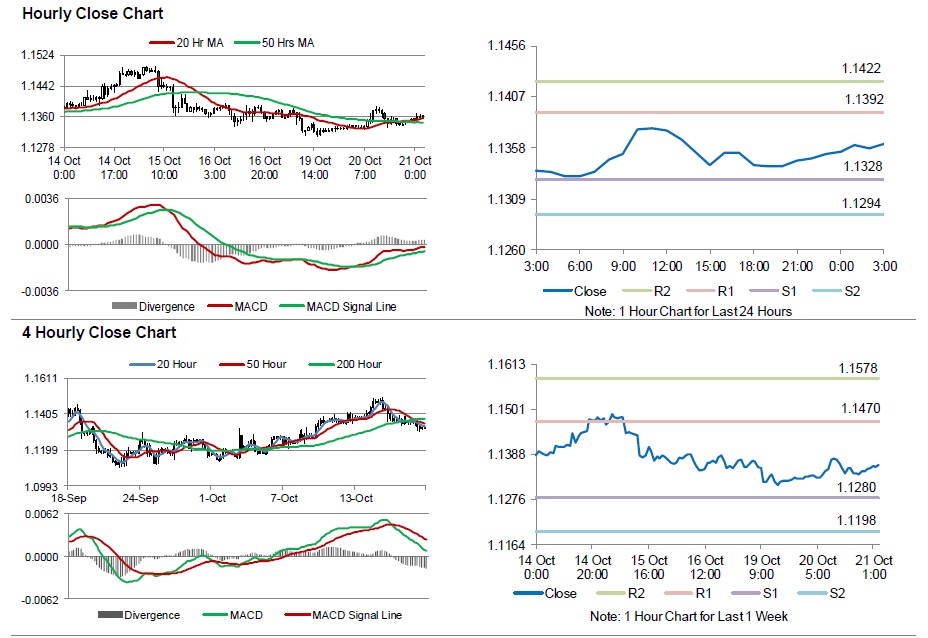

The pair is expected to find support at 1.1328, and a fall through could take it to the next support level of 1.1294. The pair is expected to find its first resistance at 1.1392, and a rise through could take it to the next resistance level of 1.1422.

Going forward, investors will keep a close watch on the ECB’s interest rate decision, scheduled to be announced tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.