For the 24 hours to 23:00 GMT, the EUR rose 0.54% against the USD and closed at 1.0852.

In economic news, Germany’s IFO business climate data declined more than expected to a level of 107.3 in January, suggesting that economic slowdown in China and other emerging markets dented the executives sentiment in the Euro-zone’s largest economy. Meanwhile markets expected it to fall to a level of 108.4 from a revised reading of 108.6 in the preceding month. Additionally, the nation’s IFO business expectations index fell more than anticipated to a level of 102.4 in January, after recording a reading of 104.7 in the previous month and compared to market expectation of a decline to a level of 104.1. Moreover, the IFO current assessment index dropped to a level of 112.5 in January, compared to previous month’s reading of 112.8.

In the US, Dallas Fed manufacturing business index unexpectedly declined to a level of -34.6 in January while markets expected it to decline to a level of -14.5. It followed a revised reading of -21.6 in the preceding month.

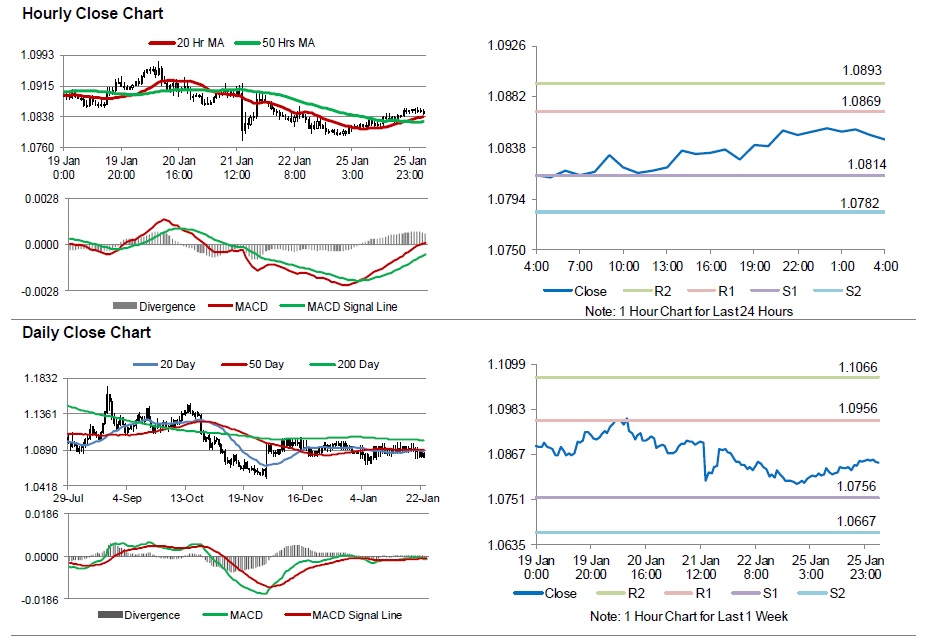

In the Asian session, at GMT0400, the pair is trading at 1.0845, with the EUR trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.0814, and a fall through could take it to the next support level of 1.0782. The pair is expected to find its first resistance at 1.0869, and a rise through could take it to the next resistance level of 1.0893.

Going ahead, investors will look forward to US Markit services PMI, consumer confidence for January and US housing price index for November, slated to be released later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.