For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1894.

The greenback lost ground against its key peers, after North Korea issued an explicit threat to the US, stating that it will use nuclear weapons to reduce US to “ashes and darkness” for leading the latest UN Security Council sanctions imposed on the country.

Earlier in the session, the US Dollar advanced, after a larger-than-expected rise in US inflation reignited hopes of another Federal Reserve interest rate hike in December.

Data indicated that the consumer price index (CPI) in the US advanced more-than-expected by 0.4% on a monthly basis in August, accelerating to a seven-month high level, suggesting that the recent weakness in inflation was temporary and that the US central bank would tighten monetary policy before the year-end. The CPI had recorded an advance of 0.1% in the prior month, while markets were anticipating for a gain of 0.3%. Additionally, on an annual basis, the nation’s CPI jumped more-than-anticipated by 1.9% on an annual basis in August, compared to an increase of 1.7% in the prior month. Market participants had envisaged the CPI to rise 1.8%.

In other economic news, first time claims for the US unemployment benefits unexpectedly fell to a level of 284.0K in the week ended 09 September, defying market consensus for an advance to a level of 300.0K, thus highlighting that the trend of a tightening labour market continues. Initial jobless claims had registered a reading of 298.0K in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1913, with the EUR trading 0.16% higher against the USD from yesterday’s close.

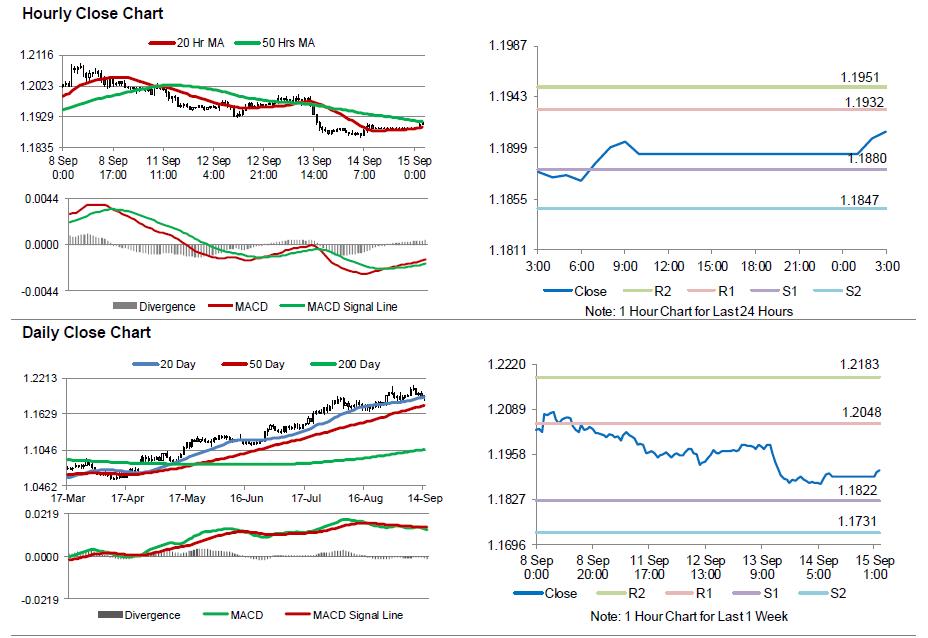

The pair is expected to find support at 1.1880, and a fall through could take it to the next support level of 1.1847. The pair is expected to find its first resistance at 1.1932, and a rise through could take it to the next resistance level of 1.1951.

Moving ahead, investors will look forward to the Euro-zone’s trade balance figures for July, slated to release in a few hours. Moreover, the US advance retail sales, industrial as well as manufacturing production data, all for August, followed by the nation’s flash Michigan consumer confidence index for September, due to release later in the day, will keep investors on their toes.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.