For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.1372, after Germany’s seasonally adjusted industrial production declined more-than-expected by 1.3% MoM in March, dropping for the second consecutive month, compared to a revised fall of 0.7% in the prior month. Market anticipation was for industrial production to ease 0.2%.

On the other hand, the nation’s trade surplus widened to a record high level of €26.0 billion in March, compared to a revised trade surplus of €20.2 billion in the prior month. Markets were anticipating a trade surplus of €20.6 billion. Meanwhile, German exports rose by 1.9% and imports fell by 2.3% on a monthly basis in March.

The greenback gained ground, after US JOLTs job openings surprisingly rose to an eight-month high level of 5.7 million in March, from a revised reading of 5.6 million in the previous month. Markets were expecting it to fall to a level of 5.4 million. Additionally, the nation’s NFIB small business optimism index advanced above expectations to a level of 93.6 in April, compared to market expectations of a rise to a level of 93.1. In the previous month, the small business optimism index had recorded a level of 92.6. Moreover, US wholesale inventories advanced in line with market expectations by 0.1% in March, compared to a revised drop of 0.6% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1389, with the EUR trading 0.15% higher from yesterday’s close.

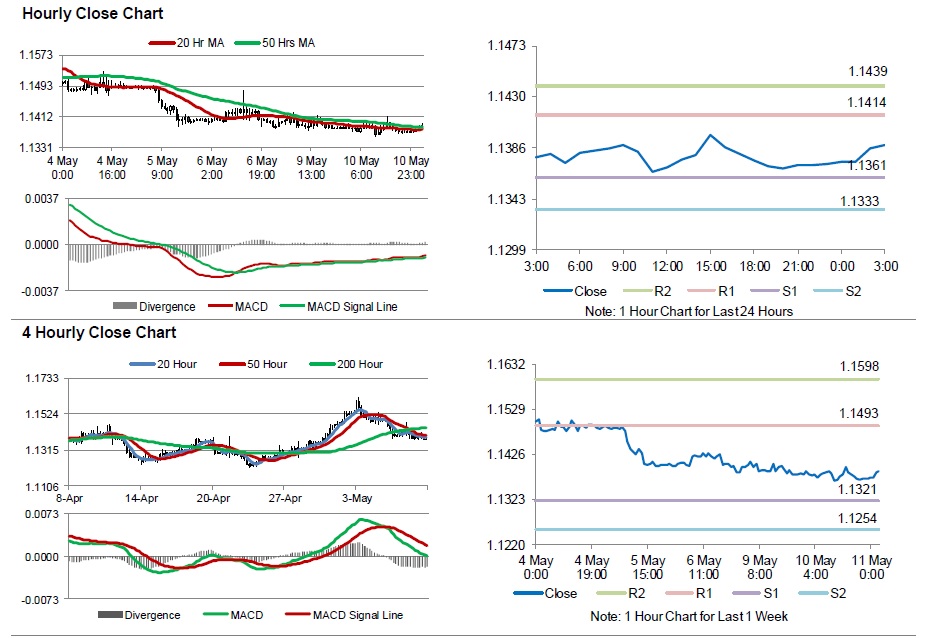

The pair is expected to find support at 1.1361, and a fall through could take it to the next support level of 1.1333. The pair is expected to find its first resistance at 1.1414, and a rise through could take it to the next resistance level of 1.1439.

Going ahead, investors will look forward to the US weekly MBA mortgage applications and monthly budget statement for April, scheduled to release later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.