For the 24 hours to 23:00 GMT, the EUR rose 0.40% against the USD and closed at 1.1703.

Macroeconomic data indicated that Germany’s Ifo business climate index dropped to a six-month low level of 101.8 in June, in line with market expectations, after recording a revised level of 102.3 in the prior month. Meanwhile, the business expectations index remained unchanged at 98.6 in June, defying market expectations for a drop to a level of 98.0. Additionally, the nation’s Ifo current assessment index eased to a level of 105.1 in June, from a revised reading of 106.1 in the previous month, while markets had anticipated for a fall to a level of 105.6.

In the US, data showed that the Chicago Fed national activity index slid to a level of -0.15 in May, indicating slower economic growth and compared to a revised reading of 0.42 in the previous month. Markets had envisaged for a fall to a level of 0.30.

On the contrary, Dallas Fed manufacturing business index unexpectedly advanced to a level of 36.5 in June, defying market consensus for a fall to a level of 24.9. In the preceding month, the index had registered a level of 26.8. Moreover, the nation’s new home sales rebounded by 6.7%, on monthly basis in May, to a level of 689.0K, higher than market expectations of 667.0K. In the prior month, new home sales had recorded a revised reading of 646.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1716, with the EUR trading 0.11% higher against the USD from yesterday’s close.

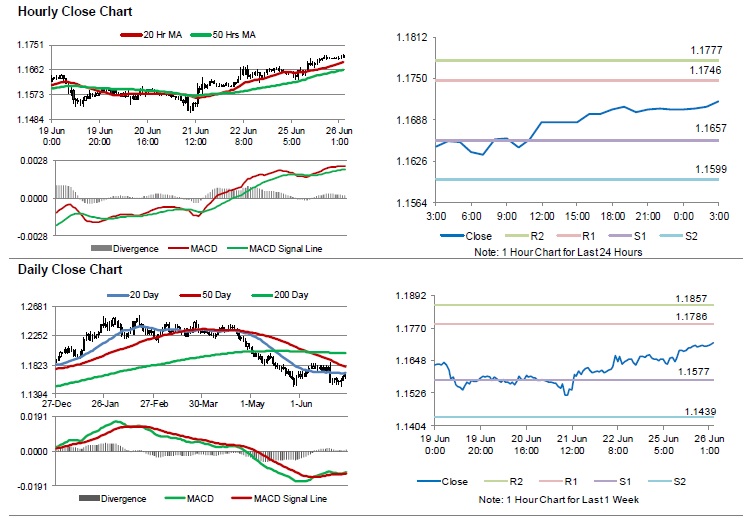

The pair is expected to find support at 1.1657, and a fall through could take it to the next support level of 1.1599. The pair is expected to find its first resistance at 1.1746, and a rise through could take it to the next resistance level of 1.1777.

Amid lack of macroeconomic releases in the Euro-bloc today, investors will look forward to the US Richmond Fed manufacturing index and consumer confidence index, both for June, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.