For the 24 hours to 23:00 GMT, the EUR declined 0.63% against the USD and closed at 1.2712, reversing its previous session gains, as reports emerged that the ECB was planning to expand its asset purchase programme by opting for corporate-debt purchases.

On the macro front, the Euro-zone’s government debt to GDP ratio increased to 90.9% at the end of 2013, compared to a revised ratio of 89.0% recorded at the end of 2012.

The US Dollar gained ground after existing home sales in the US rose 2.4% in September on a monthly basis, registering its highest level of the year. Markets were expecting home sales to register a gain of 1.0%, following a drop of 1.8% in the prior month.

In other economic news, the US Redbook index climbed 4.1% on an annual basis in the week ended October 17, compared to a rise of 3.8% recorded in the previous week.

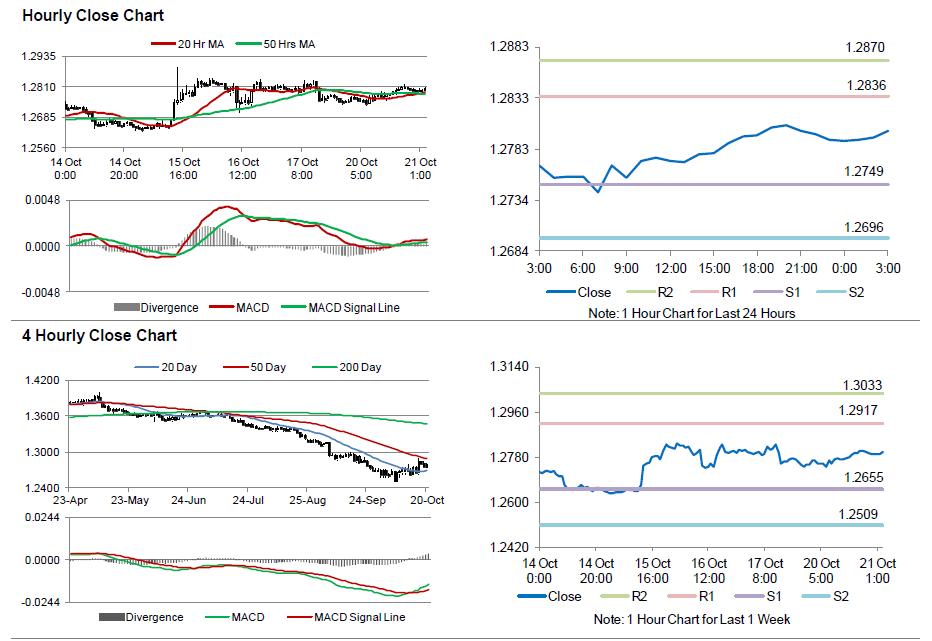

In the Asian session, at GMT0300, the pair is trading at 1.2726, with the EUR trading 0.11% higher from yesterday’s close.

The pair is expected to find support at 1.2674, and a fall through could take it to the next support level of 1.2623. The pair is expected to find its first resistance at 1.2809, and a rise through could take it to the next resistance level of 1.2893.

Amid no economic releases from the Euro-zone today, investors would concentrate on the US CPI data, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.