For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.1619.

The US Federal Reserve (Fed), at its recent policy meeting, decided to keep its benchmark interest rate target between 1.00% and 1.25%, as widely expected by market participants, and struck a positive tone on the current state of the US economy. In its policy statement, the central bank highlighted that the US labour market has continued to strengthen and that economic growth has been rising at a robust pace, despite some disruptions caused by recent hurricanes, suggesting that an interest rate hike is most likely in December.

On the macro front, the US ISM manufacturing PMI dropped more than anticipated to 58.7 in October, compared to a level of 60.8 in the previous month. Markets had expected the ISM manufacturing activity index to fall to a level of 59.5. Also, the final US Markit manufacturing PMI rose to 54.6, compared to market expectations of a rise to a level of 54.5. In the prior month, the manufacturing PMI had registered a reading of 53.1. In the job market report, the private sector employment in the US advanced by 235.00K in October, following a revised increase of 110.00K in the prior month. Markets were anticipating the private sector employment to gain 200.00K.

Moreover, US construction spending unexpectedly climbed by 0.3% in September, compared to a revised rise of 0.1% in the previous month. Market anticipation was for construction spending to ease 0.2%. Additionally, US mortgage applications slid 2.6% in the week ended 27 October 2017 from a drop of 4.6% in the prior week.

Separately, news surfaced that US President, Donald Trump, might appoint Fed Governor, Jerome Powell, as the next Fed Chairman. The announcement is expected to be made by the President today.

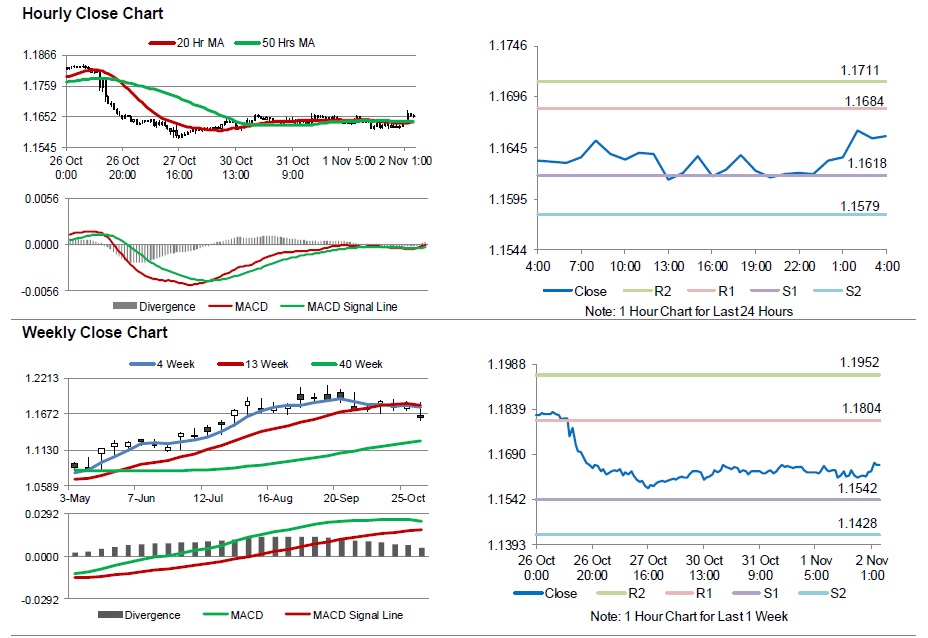

In the Asian session, at GMT0400, the pair is trading at 1.1657, with the EUR trading 0.33% higher from yesterday’s close.

The pair is expected to find support at 1.1618, and a fall through could take it to the next support level of 1.1579. The pair is expected to find its first resistance at 1.1684, and a rise through could take it to the next resistance level of 1.1711.

Moving forward, Eurozone’s final manufacturing PMI for October, and Germany’s unemployment rate and manufacturing PMI, would be closely assessed by traders. In the US, weekly initial jobless claims and non-farm productivity data for the third quarter, both due later today, would be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.