For the 24 hours to 23:00 GMT, the EUR rose 0.76% against the USD and closed at 1.0494.

In the US, data revealed that advance goods trade deficit unexpectedly widened to $65.3 billion in November, as a stronger greenback weighed on the nation’s exports. Markets expected the nation’s goods trade deficit to narrow to $61.6 billion, following a revised deficit of $61.9 billion in the previous month. On the other hand, the nation’s initial jobless claims dropped to a level of 265.0K in the week ended 24 December 2016, meeting market expectations and pointing to a resilient labour market. In the prior week, initial jobless claims had recorded a reading of 275.0K. Also, the nation’s preliminary wholesale inventories advanced 0.9% MoM in November, more than market expectations for a rise of 0.2% and after recording a revised drop of 0.1% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0528, with the EUR trading 0.32% higher against the USD from yesterday’s close.

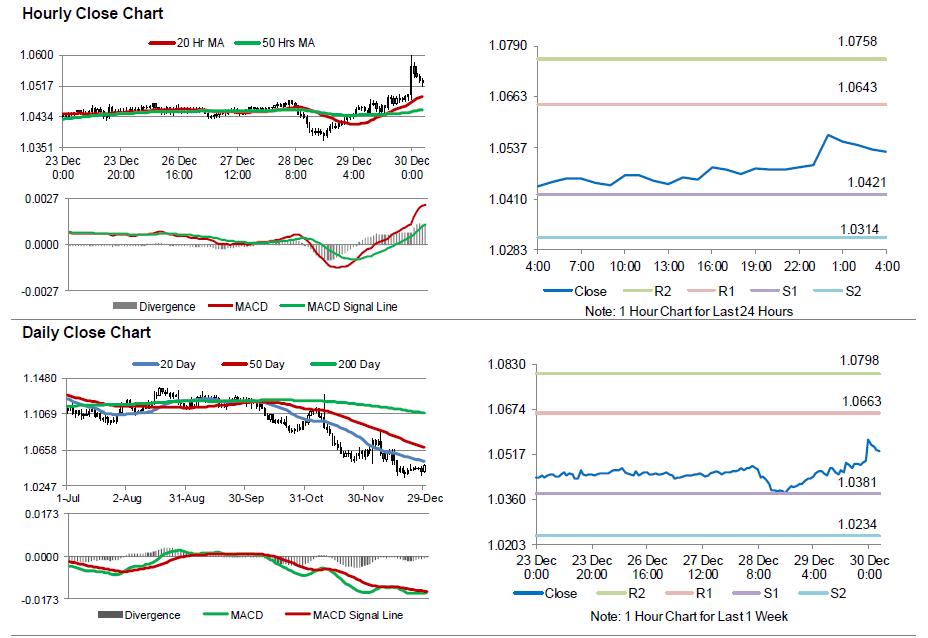

The pair is expected to find support at 1.0421, and a fall through could take it to the next support level of 1.0314. The pair is expected to find its first resistance at 1.0643, and a rise through could take it to the next resistance level of 1.0758.

Next week, market participants would focus on the flash consumer price inflation, final manufacturing and services PMIs, across the Euro-zone along with the ECB’s recent meeting minutes, to get better insights into the region’s economy. Additionally, Germany’s unemployment rate, construction PMI as well as factory orders data, all due next week, would also be keenly watched by investors. Moreover, traders would also look forward to the US Chicago purchasing managers’ index, scheduled to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.