For the 24 hours to 23:00 GMT, the EUR declined 0.87% against the USD and closed at 1.1891.

On the macro front, Germany’s producer price index climbed more-than-expected by 2.6% on an annual basis in August, compared to a rise of 2.3% in the previous month, while markets were anticipating the index to gain 2.5%.

The greenback gained ground against a basket of major currencies, after the US Federal Reserve (Fed), in a surprise move, indicated that it expects one more interest rate hike before the year-end.

The Fed, at its latest monetary policy meeting, left its key interest rate unchanged between 1.00% and 1.25% and announced a plan to start unwinding its $4.5 trillion balance sheet next month. In a statement accompanying the decision, the central bank offered a broadly optimistic view on the current economic conditions and signalled that it was still eyeing a possible third rate hike this year. However, the Fed Chairwoman, Janet Yellen, stated that a fall in inflation this year remained a mystery and added that the US central bank stands ready to change the interest rate outlook if needed.

Meanwhile, in its latest Summary of Economic Projections, the Fed forecasted the US economy to grow 2.4% this year, faster than a projection of 2.2% made in June. However, the central bank also lowered its inflation projection to be 1.9% by the end of 2018, slightly below its earlier forecast of 2.0%.

On the data front, existing home sales in the US unexpectedly fell 1.7% on monthly basis to a level of 5.35 million units in August, declining to its lowest level in a year, amid a shortage of properties and a sharp drop in Houston home purchases due to Hurricane Harvey. In the previous month, existing home sales recorded a level of 5.44 million, while markets had envisaged for an advance to a level of 5.45 million.

In the Asian session, at GMT0300, the pair is trading at 1.1883, with the EUR trading 0.07% lower against the USD from yesterday’s close.

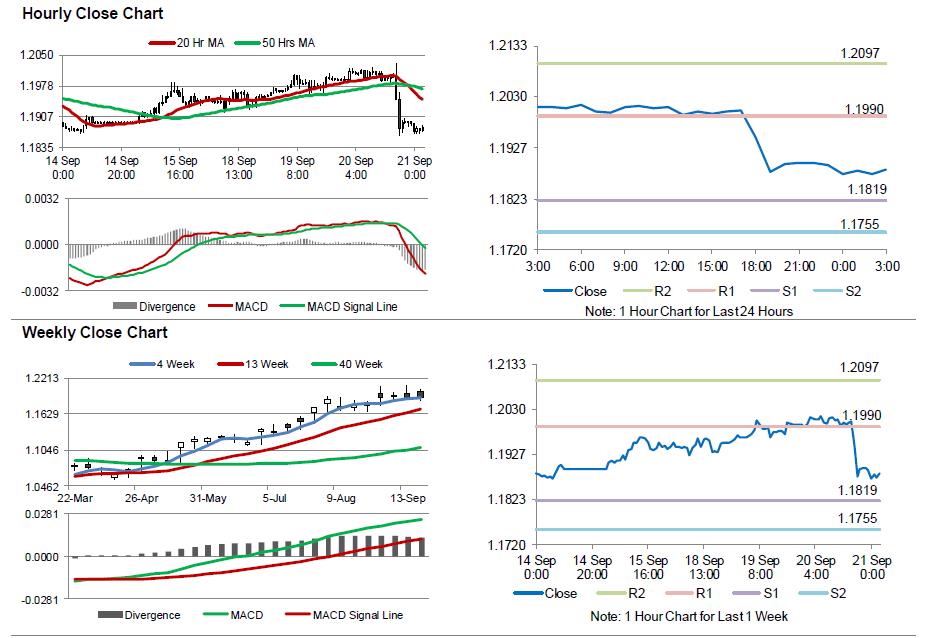

The pair is expected to find support at 1.1819, and a fall through could take it to the next support level of 1.1755. The pair is expected to find its first resistance at 1.1990, and a rise through could take it to the next resistance level of 1.2097.

Going ahead, market participants will closely monitor a speech by the ECB President, Mario Draghi as well as the release of the Euro-zone’s flash consumer confidence index for September, both due later in the day. Also, the ECB’s economic bulletin report, slated to release in a few hours, will be on investors’ radar. Moreover, the US initial jobless claims and leading indicators data for August, scheduled to release later today, will attract a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.