For the 24 hours to 23:00 GMT, the EUR declined 1.00% against the USD and closed at 1.0927, after Germany’s GfK consumer confidence index weakened in November.

Data showed that Germany’s Gfk consumer confidence index dropped 0.2 points to a level of 9.4 in November, reaching its lowest level since February, from a reading of 9.6 in the previous month. The decline was attributed to the migrant crisis that is underway in Europe. Moreover, the consumer confidence in France fell to a level of 96.0 in October, compared to market expectations of a steady reading. In the prior month, the index had registered a level of 97.0.

On the other hand, Italy’s consumer confidence unexpectedly advanced to a reading of 116.9 in October, rising for the third consecutive month, from an upwardly revised level of 113.0 in September.

Separately, the ECB’s chief economist, Peter Praet, mentioned that the central bank will not hesitate from using all its instruments in order to achieve its goal. In other speech, the ECB Vice President, Vitor Constancio, stated that the central bank will stick to low interest rates and will continue to expand its balance sheet through asset purchases until inflation rebounds.

The greenback gained ground after the Federal Reserve left benchmark interest rate unchanged in the October monetary policy meeting. It issued a surprisingly hawkish post-meeting statement, clearly indicating that the US central bank will be looking for progress in employment and labour when deliberating a rate hike at its December meeting. In particular, the Fed suggested that recent global headwinds have eased and downgraded concerns surrounding slowing growth in China.

In other economic news, the US MBA mortgage applications registered a drop of 3.5%, in the week ended 23 October, from a 11.8% rise in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.0925, with the EUR trading marginally lower from yesterday’s close.

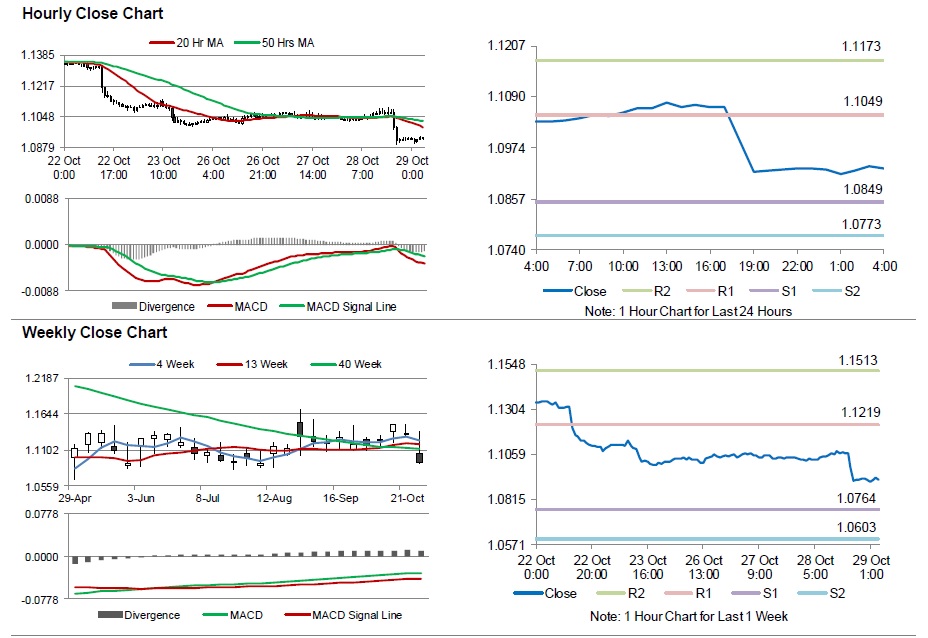

The pair is expected to find support at 1.0849, and a fall through could take it to the next support level of 1.0773. The pair is expected to find its first resistance at 1.1049, and a rise through could take it to the next resistance level of 1.1173.

Moving ahead, market participants will look forward to Germany’s unemployment rate and consumer price index data, both for the month of October, scheduled to be released today. Additionally, the US Q3 GDP data and weekly initial jobless claims, scheduled to be released later in the day, will also garner a significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.