For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.1017.

In economic news, the Euro-zone’s Sentix investor confidence index unexpectedly dropped to a level of 18.4 in August, from prior month’s reading of 18.5 and compared to market expectations of an increase to 20.3.

In the US, the Fed’s Vice Chairman, Stanley Fischer, in his speech, remained dovish about the interest rate hike in the nation. He opined even though the US labour market has shown significant improvement, consumer prices continues to be very low due to decline in commodity prices, adding that the Fed should wait till inflation starts to move towards its target of 2.0%.

In other speech, the Atlanta Fed President, Dennis Lockhart remained upbeat about the US economy and indicated that the nation was inching near an interest rate hike, as the economy is heading closer to normal mark.

In the Asian session, at GMT0300, the pair is trading at 1.0975, with the EUR trading 0.38% lower from yesterday’s close.

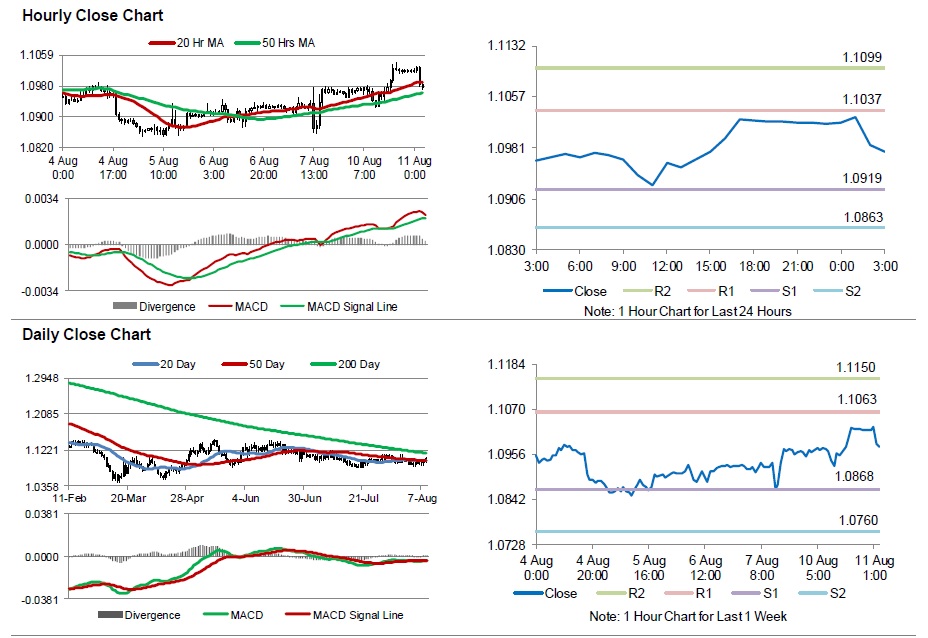

The pair is expected to find support at 1.0919, and a fall through could take it to the next support level of 1.0863. The pair is expected to find its first resistance at 1.1037, and a rise through could take it to the next resistance level of 1.1099.

Going forward, market participants will eye Germany’s crucial ZEW economic survey data, set for release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.