For the 24 hours to 23:00 GMT, the EUR declined 1.52% against the USD and closed at 1.1147, mainly because of dovish comments from the ECB official along with Germany’s disappointing ZEW survey data.

Yesterday, ECB’s Executive Board Member, Benoit Coeure stated that the central bank intended to buy more securities in May and June, to offset a lack of liquidity in the summer months.

The Euro further fell, after Germany’s ZEW Indicator of economic sentiment fell sharply to a five-month low level of 41.9 in May from 53.3 in April, as the nation’s lacklustre first quarter growth figure weighed on economic outlook of the Euro-zone’s biggest economy. Meanwhile, the Euro-zone’s CPI climbed 0.20% on a MoM basis in April, in line with market expectations. In the prior month, the index had advanced 1.10%.

Other economic data showed that the Euro-zone’s trade surplus widened more than expected to €23.4 billion in March, compared to previous month’s level of €20.3 billion.

The greenback gained ground, following stronger than expected economic releases in the US.

Data released showed that the US housing starts jumped 20.2% MoM in April, surpassing market expectations for a 9.6% rise, while building permits rebounded 10.1% and registered a seven year high level on a monthly basis in April.

In the Asian session, at GMT0300, the pair is trading at 1.1144, with the EUR trading marginally lower from yesterday’s close.

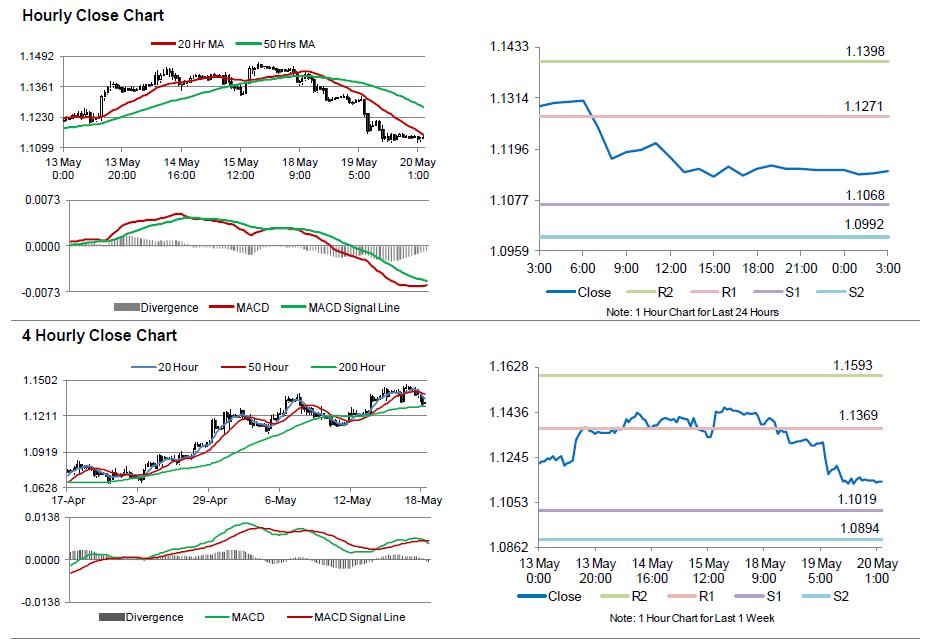

The pair is expected to find support at 1.1068, and a fall through could take it to the next support level of 1.0992. The pair is expected to find its first resistance at 1.1271, and a rise through could take it to the next resistance level of 1.1398.

Trading trends in the pair today are expected to be determined by the FOMC minutes, scheduled later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.