For the 24 hours to 23:00 GMT, the EUR rose 0.34% against the USD and closed at 1.1796.

In the US, data revealed that the Chicago Fed national activity index unexpectedly rose to a level of 0.34 in April, confounding market expectations for a drop to a level of 0.30. In the previous month, the index had registered a revised level of 0.32.

In the Asian session, at GMT0300, the pair is trading at 1.1783, with the EUR trading 0.11% lower against the USD from yesterday’s close.

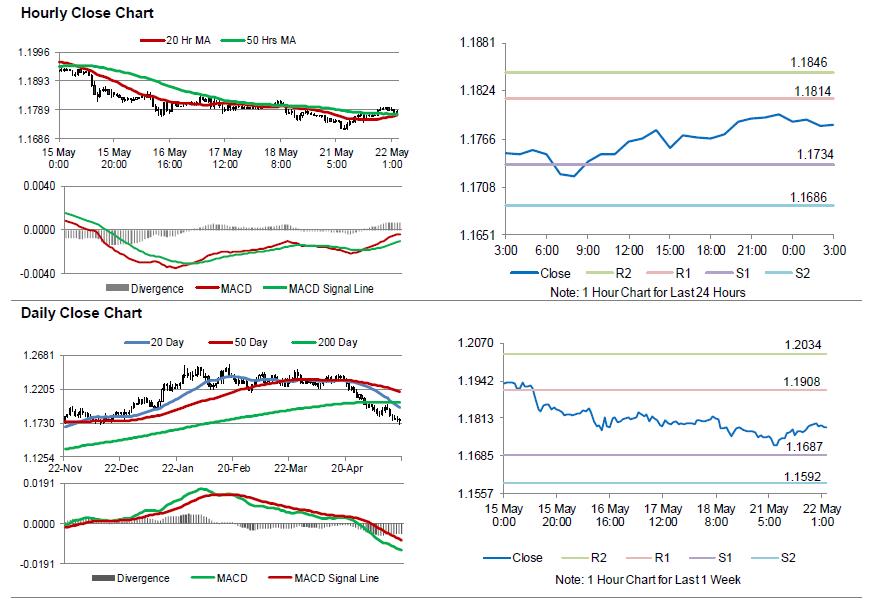

The pair is expected to find support at 1.1734, and a fall through could take it to the next support level of 1.1686. The pair is expected to find its first resistance at 1.1814, and a rise through could take it to the next resistance level of 1.1846.

With no macroeconomic releases scheduled in the Euro-zone today, investors would direct their attention to the US Richmond Fed manufacturing index for May, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.