For the 24 hours to 23:00 GMT, the EUR rose 0.31% against the USD and closed at 1.1190.

In economic news, seasonally adjusted Italian retail sales unexpectedly declined by 0.6% MoM in March, from 0.3% in the preceding month. Investors had expected it to rise by 0.2%.

The greenback weakened after US durable goods orders data showed weakness in business spending plans. The nation’s flash durable goods orders rose more-than-expected by 3.4% in April, compared to market expectations for an advance of 0.5% and following a revised 1.9% gain in the previous month. However, underlying data showed that US business spending intentions weakened in April for the third straight month. Further, US initial jobless claims eased to a one-month low level of 268.0K in the week ended 21 May 2016, falling for the second consecutive week and compared to a reading of 278.0K in the prior week. Market expectation was for initial jobless claims to ease to a level of 275.0K. Moreover, the nation’s pending home sales advanced more-than-anticipated by 5.1% MoM in April, its highest level in more than a decade, following a revised 1.6% gain in the previous month. Investors had expected it to rise by 0.7%.

Separately, the US Federal Reserve (Fed) Governor, Jerome Powell, indicated that an interest rate hike may come “fairly soon”, if incoming data confirms that the US economy continues to grow and the labour market is still tightening.

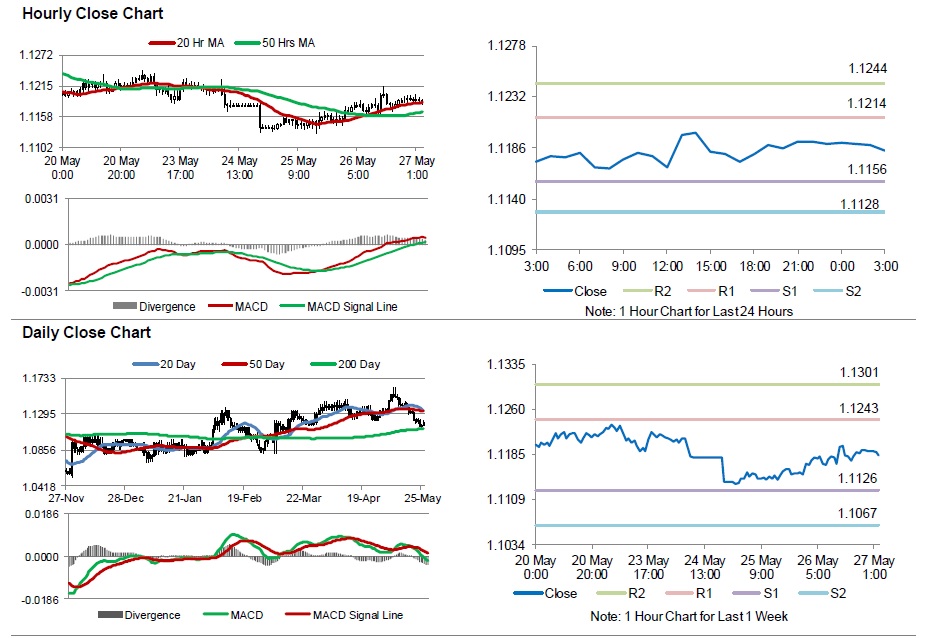

In the Asian session, at GMT0300, the pair is trading at 1.1184, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1156, and a fall through could take it to the next support level of 1.1128. The pair is expected to find its first resistance at 1.1214, and a rise through could take it to the next resistance level of 1.1244.

Going ahead, investors look forward to France and Italy’s consumer confidence index data, scheduled to release in a few hours. Moreover, the US 1Q GDP data and the Fed Chairwoman, Janet Yellen’s speech, due later today, will attract a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.