For the 24 hours to 23:00 GMT, the EUR rose 0.33% against the USD and closed at 1.3691. The greenback declined following the release of a mixed batch of economic releases from the US economy. Data showed that the US pending home sales index advanced 6.1% (MoM) in May, its biggest rise since April 2010, while Chicago Purchasing Managers’ Index declined more than market expectations to a reading of 62.6 in June. Separately, the San Francisco Fed President, John Williams urged the US central bank to keep its interest rates at near zero level for at least another year, even as the world’s largest economy is seen to have approached normalcy in the future.

Meanwhile, in the Euro-zone, data showed that, preliminary reading of the year-on-year consumer inflation rate remained unchanged at previous month’s level of 0.5%, remaining below the central bank’s inflation target for the ninth consecutive month in June. Separately, the ECB reported that loans to Euro-zone’s private sector fell by 2.0%, while M3 supply in the common currency bloc rose more-than-expected 1.0% (YoY) in May. Meanwhile, data from Germany revealed that retail sales in the nation unexpectedly fell 0.6% (MoM) in May, following a revised 1.5% drop in April.

In the Asian session, at GMT0300, the pair is trading at 1.3689, with the EUR trading a tad lower from yesterday’s close.

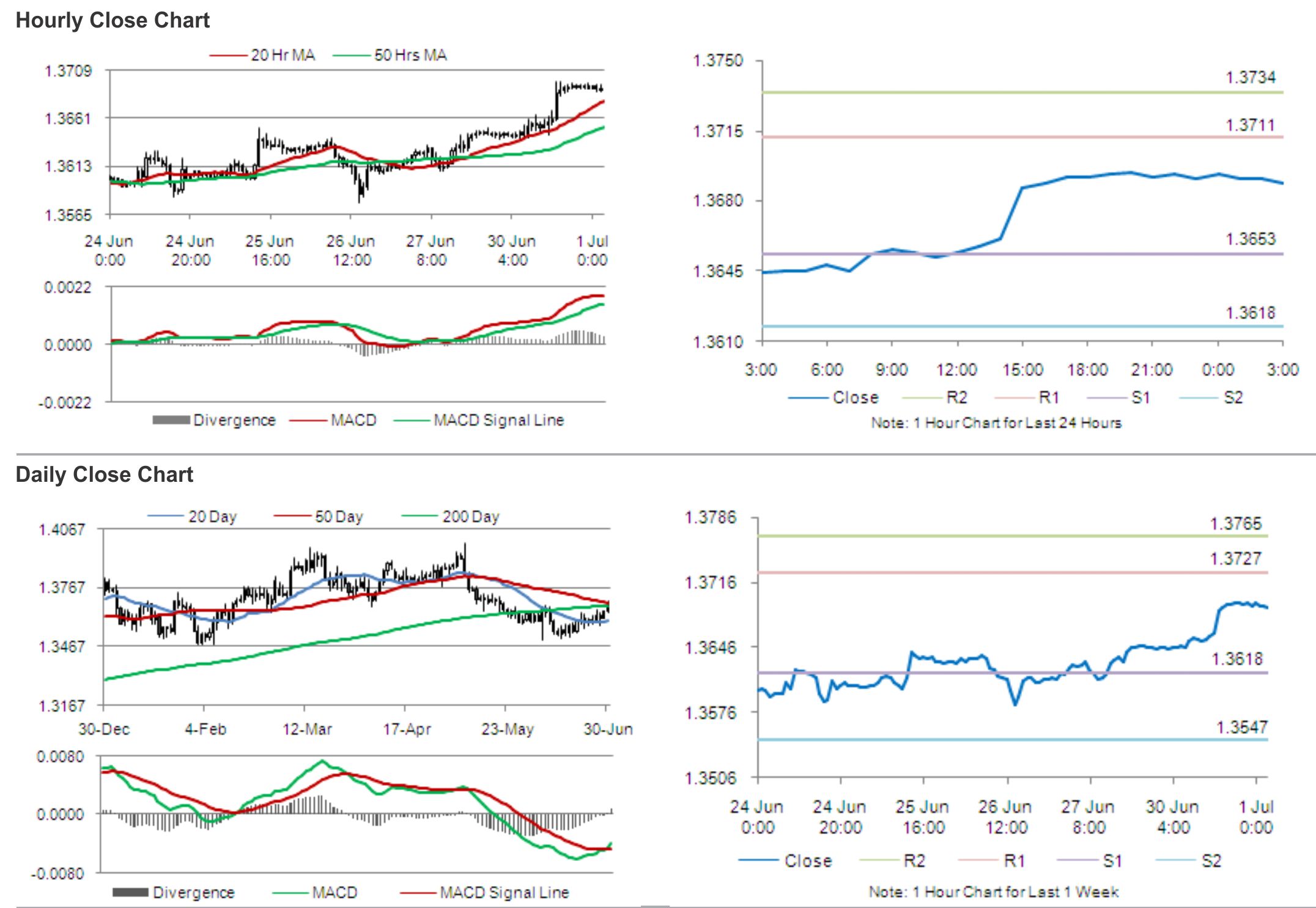

The pair is expected to find support at 1.3653, and a fall through could take it to the next support level of 1.3618. The pair is expected to find its first resistance at 1.3711, and a rise through could take it to the next resistance level of 1.3734.

Amid a slew of economic releases in the Euro-zone, later today, traders would mainly focus on Euro-zone’s and German Markit manufacturing PMI and unemployment data, for further cues in the Euro. Separately, greenback traders would also await the release of the US ISM manufacturing PMI data before taking any major bet in the US Dollar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.