For the 24 hours to 23:00 GMT, the EUR rose 0.88% against the USD and closed at 1.1241.

In economic news, final reading of the Euro zone’s seasonally adjusted GDP registered a rise of 0.3% QoQ in 2Q 2016, in line with market expectations and confirming its preliminary reading. In the prior quarter, GDP had risen 0.60%.

Meanwhile in Germany, seasonally adjusted German factory orders rose less-than-expected by 0.2% MoM in July, after registering a revised drop of 0.3% in the prior month. Further, the nation’s construction PMI held steady at a level of 51.6 in August.

The greenback lost ground after data showed that the US services sector grew at its slowest pace since early 2010, which in turn added to views that the Federal Reserve (Fed) will refrain from raising interest rate at its meeting this month. The US ISM non-manufacturing PMI dropped more-than-expected to a level of 51.4 in August, from a reading of 55.5 in the previous month. Also, the nation’s IBD/TIPP economic optimism index fell to a level of 46.7 in September, following a reading of 48.4 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1251, with the EUR trading 0.09% higher against the USD from yesterday’s close.

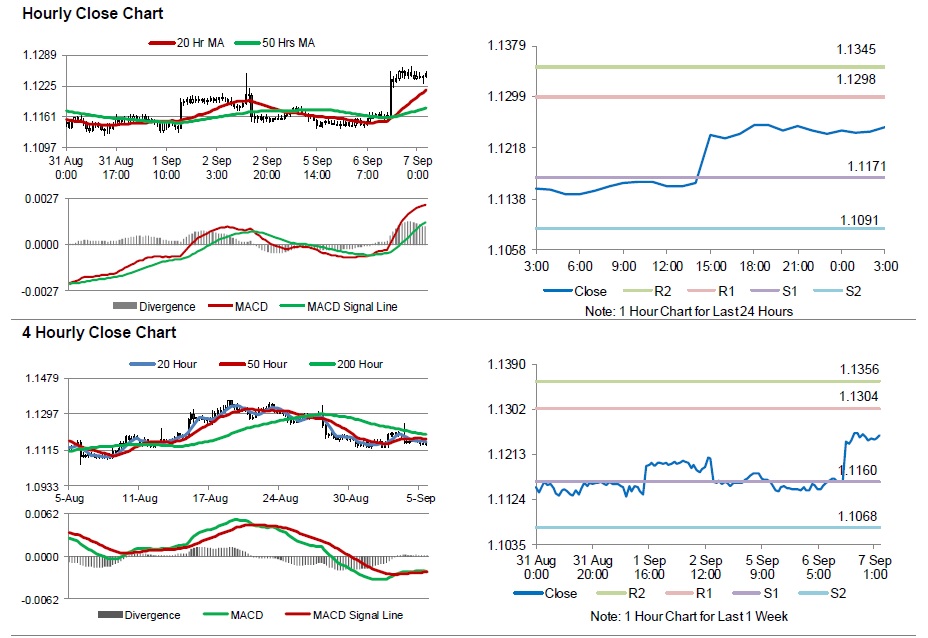

The pair is expected to find support at 1.1171, and a fall through could take it to the next support level of 1.1091. The pair is expected to find its first resistance at 1.1298, and a rise through could take it to the next resistance level of 1.1345.

Going ahead, investors will look forward to Germany’s industrial production data for July, scheduled to release in a few hours. Moreover, the US Fed’s Beige Book report and JOLTS job openings data for July will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.