For the 24 hours to 23:00 GMT, the EUR declined 0.52% against the USD and closed at 1.1130, after the Euro-zone’s consumer confidence index deteriorated further in September.

Data showed that the Euro-Zone consumer confidence indicator fell to a level of 7.1 in September, after witnessing a decline of 6.9 in the previous month, while market participants had expected the index to decline to 7.0.

In the US, the House Price Index advanced 0.6% on a monthly basis in July, exceeding market expectations for a rise of 0.4%. It registered a gain of 0.2% in the previous month.

Other economic data showed that the Richmond Fed Manufacturing Index came out worse-than-expected at a level of -5.0 in September, against a flat reading in the previous month. Investors had anticipated the index to advance to 2.0.

In the Asian session, at GMT0300, the pair is trading at 1.1134, with the EUR trading marginally higher from yesterday’s close.

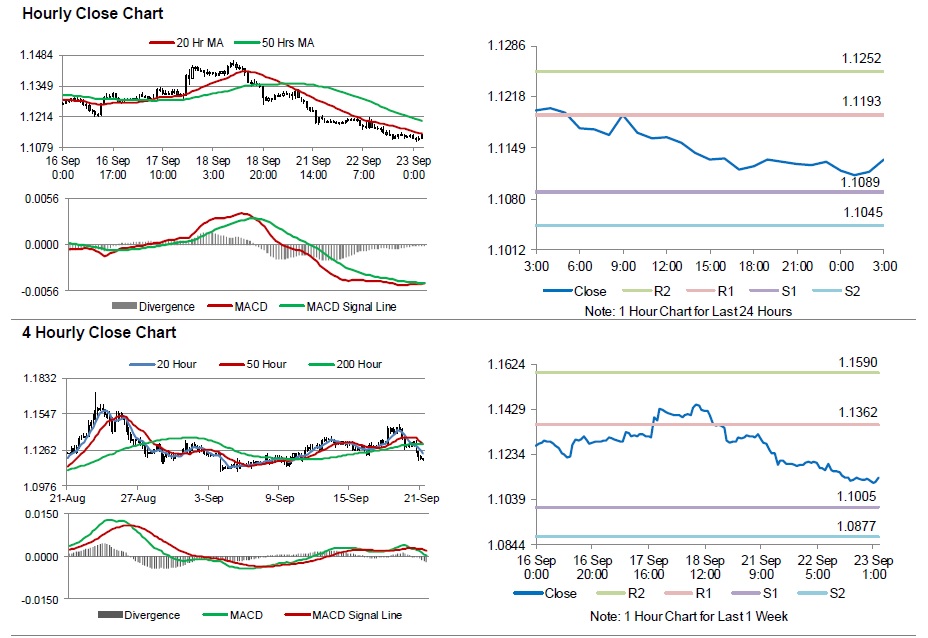

The pair is expected to find support at 1.1089, and a fall through could take it to the next support level of 1.1045. The pair is expected to find its first resistance at 1.1193, and a rise through could take it to the next resistance level of 1.1252.

Trading trends in the Euro today are expected to be determined by the services and manufacturing PMI data across the Euro-zone, scheduled in a few hours. Additionally, the ECB Chief, Mario Draghi’s speech scheduled later today would grab lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.