For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.1411.

In economic news, Italy’s seasonally adjusted industrial production declined less-than-expected by 0.6% MoM in February, compared to a revised rise of 1.7% in the previous month. Market anticipation was for industrial production to drop 0.7%. However, it was the steepest fall in the nation’s industrial output since June 2015.

In the US, the Dallas Fed President, Robert Kaplan, indicated that he does not support an April interest rate increase, due to lack of clarity on the US economic growth. However, he stated that a June rate hike remains a possibility.

In the Asian session, at GMT0300, the pair is trading at 1.1408, with the EUR trading marginally lower from yesterday’s close.

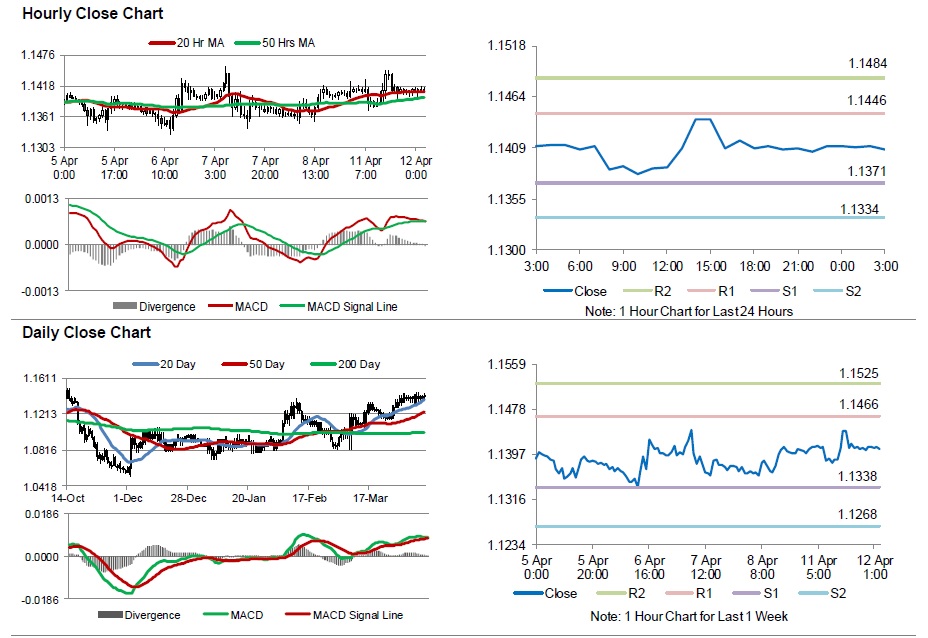

The pair is expected to find support at 1.1371, and a fall through could take it to the next support level of 1.1334. The pair is expected to find its first resistance at 1.1446, and a rise through could take it to the next resistance level of 1.1484.

Moving ahead, market participants will look forward to Germany’s consumer price index data for March, scheduled to release in a few hours. Moreover, the US monthly budget statement, due later in the day, will also attract investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.