For the 24 hours to 23:00 GMT, the EUR declined 0.80% against the USD and closed at 1.0721, after economic growth in the Euro-zone and Germany eased marginally in the third quarter, thus intensifying expectations for further stimulus measures by the ECB at its upcoming meeting.

Macroeconomic data showed that Euro-zone’s preliminary gross domestic product (GDP) rose less-than-expected by 0.3% QoQ in 3Q 2015, after rising by 0.4% in the previous quarter. Investors had expected it to remain steady. Additionally, Germany’s flash GDP recorded a rise of 0.3% during the same period, in line with expectations, and after rising by 0.4% in the previous quarter.

The greenback gained ground, after a strong US consumer sentiment data offset a disappointing retail sales and producer price index data.. The preliminary Reuters/Michigan consumer sentiment index advanced to a level of 93.1 in November, higher than market expectations for a reading of 91.5. The index had registered a reading of 90.0 in the previous month. Also, US business inventories surprisingly rose 0.3% in September, after edging up by a revised 0.1% in August. Investors had expected it to remain unchanged.

On the other hand, advance retail sales in the US rose less-than-expected by 0.1% MoM in October, compared to a revised flat reading in the previous month, and against market expectations for a rise of 0.3%, thus indicating that a slowdown in consumer spending could hit economic growth in the fourth quarter. Additionally, the nation’s producer price index unexpectedly declined 0.4% MoM in October, dropping for the second consecutive month, after falling by 0.5% in the previous month. Market expectation was for it to advance 0.2%.

In the Asian session, at GMT0400, the pair is trading at 1.0725, with the EUR trading marginally higher from Friday’s close.

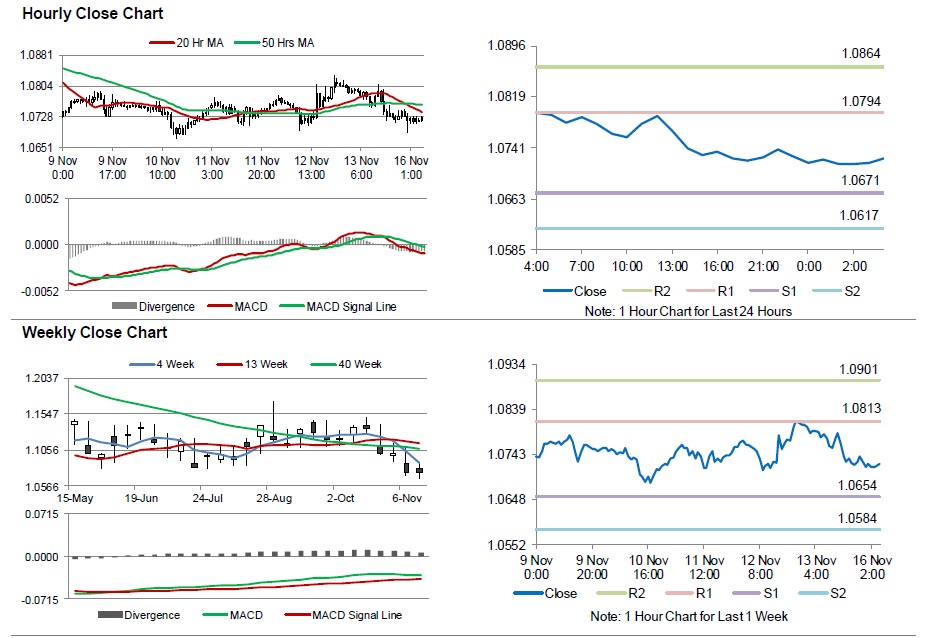

The pair is expected to find support at 1.0671, and a fall through could take it to the next support level of 1.0617. The pair is expected to find its first resistance at 1.0794, and a rise through could take it to the next resistance level of 1.0864.

Moving ahead, investors will keep an eye on Euro-zone’s preliminary consumer price inflation data for October, scheduled to be released in a few hours, for further cues.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.