For the 24 hours to 23:00 GMT, the EUR rose 0.15% against the USD and closed at 1.1013.

In economic news, the Euro-zone’s Sentix investor confidence index fell unexpectedly to a level of 5.5 in March, falling for the third consecutive month and touching its lowest level in more than a year, as investors remain less optimistic about global growth prospects. Markets expected the index to advance to a level of 8.3, compared to a level of 6.0 in the previous month. Meanwhile, in Germany, seasonally adjusted factory orders fell less-than-anticipated by 0.1% MoM in January, following a revised fall of 0.2% in the previous month and compared to investor expectations for a drop of 0.3%.

In the US, consumer credit rose less-than-expected by $10.5 billion in January, compared to a revised rise of $21.4 billion in the prior month while markets expected it to rise by $17.0 billion. Additionally, the nation’s labour market conditions index surprisingly fell to a level of 2.4 in February, following a revised drop of 0.8 in the preceding month and compared to market expectations for a rise to a level of 1.0.

Separately, the US Fed Vice Chairman, Stanley Fischer, indicated that US inflation is likely to pick-up pace and vouched for a near-term interest rate hike. On the other hand, the Fed Governor, Lael Brainard, suggested that the Fed should remain patient on further interest rate hikes until inflation proves its “persistence”, amid tightening global financial conditions and decelerating foreign demand.

In the Asian session, at GMT0400, the pair is trading at 1.1018, with the EUR trading marginally higher from yesterday’s close.

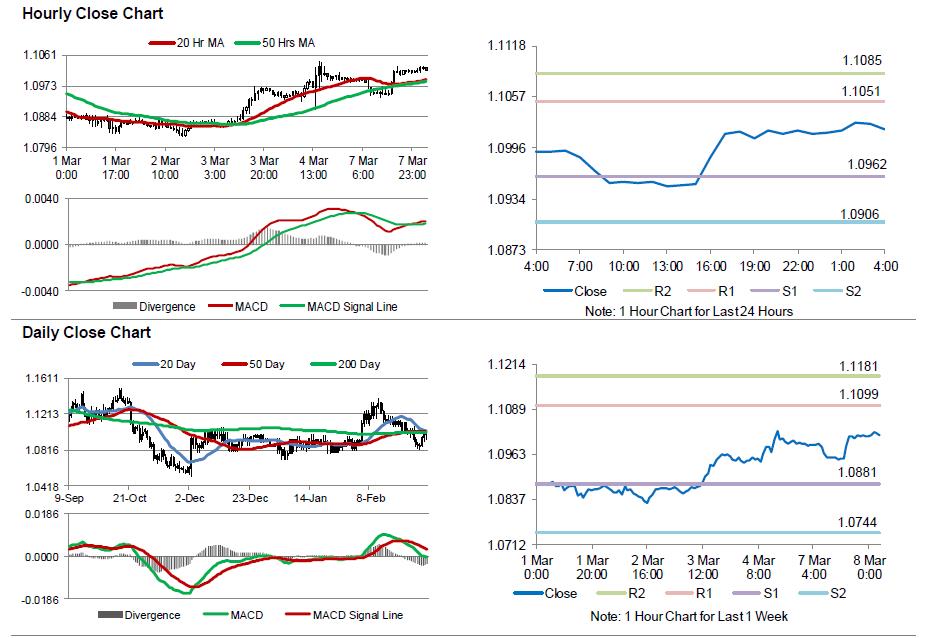

The pair is expected to find support at 1.0962, and a fall through could take it to the next support level of 1.0906. The pair is expected to find its first resistance at 1.1051, and a rise through could take it to the next resistance level of 1.1085.

Going ahead, market participants will keep a close watch on Euro-zone’s preliminary Q4 GDP and Germany’s industrial production data, slated to be released in a few hours. Additionally, the US NFIB small business optimism and IBD/TIPP economic optimism indices, scheduled to be released later in the day, will also garner a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.