For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.1386.

Yesterday, Germany’s consumer price inflation remained unchanged YoY in September, as expected. On a MoM basis too, the index met investor expectations as it fell 0.2%, mainly led by a decline in energy prices. At the same time, wholesale price inflation fell 0.6% MoM in August, compared to 0.8% decline in August. On an annual basis, wholesale prices dropped 1.8% during the same month, compared to a 1.1% fall in August.

In other economic news, the German ZEW economic sentiment index fell to a 12-month low reading of 1.9 points in October, from a level of 12.1 points in the previous month. Investors had expected it to decline to 6.0. The sharp drop is attributed to the Volkswagen pollution cheating scandal and concerns surrounding growth in China. The ZEW current situation index dropped to a worse-than-expected level of 55.2 in October, from 67.5 in the previous month. Market participants had expected it to fall to a reading of 64.7.

Meanwhile, the Euro-zone ZEW economic sentiment index fell to 30.1 in October, in line with expectations, from 33.3 in the previous month.

In the US, St. Louis Fed President, James Bullard was more hawkish, calling for the Fed to begin raising rates before the end of the year. However, when asked about a hike at the October meeting, James Bullard said that it would be tough for the US Federal Reserve to change course after only one month of additional data. He further stated that he still expects the US economy to grow above the 2.0% trend rate and inflation to move above the Fed’s 2.0% target by 2017. Bullard also suggested that the concern about China’s economy might be exaggerated.

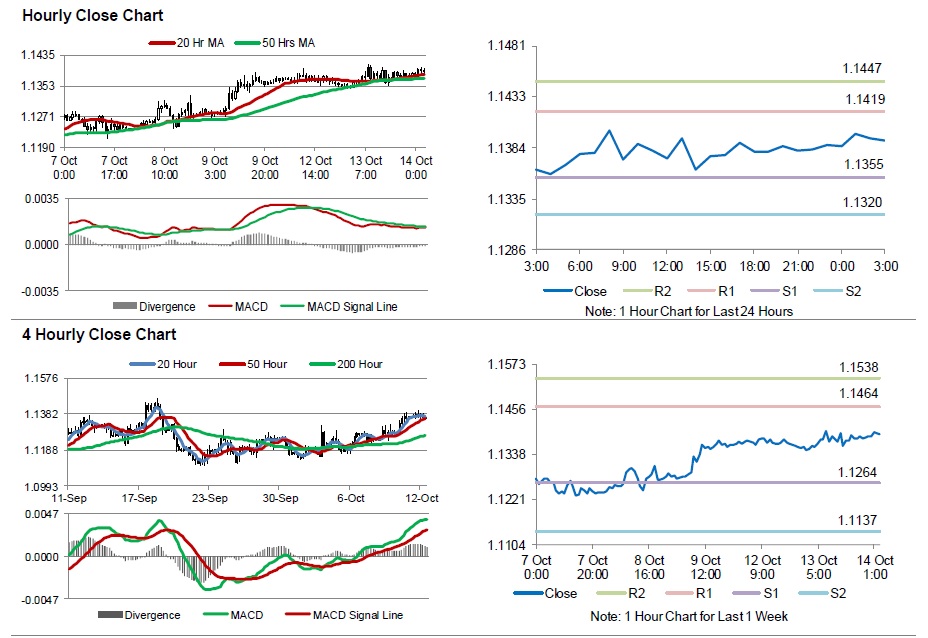

In the Asian session, at GMT0300, the pair is trading at 1.139, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1355, and a fall through could take it to the next support level of 1.132. The pair is expected to find its first resistance at 1.1419, and a rise through could take it to the next resistance level of 1.1447.

Moving ahead, market participants will closely monitor the consumer price inflation data across the Euro-zone, scheduled in a few hours. In addition to this, the Euro-zone industrial production data, scheduled later today will grab a significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.