For the 24 hours to 23:00 GMT, the EUR rose 0.29% against the USD and closed at 1.1298.

In economic news, Italy’s non-EU trade surplus rose to a level of €4.0 billion in March, following a revised trade surplus of €2.6 billion in the previous month.

The greenback lost ground, after the release of dismal US economic data, boosting expectations that the Federal Reserve would hold interest rates lower for longer.

Data showed that US flash durable goods orders rebounded less than anticipated by 0.8% in March, as demand for automobiles, computers and electrical goods plunged, indicating that the downturn in the factory sector was far from over. Investors had expected it to rise by 1.9%, following a 3.0% decline in the previous month. Moreover, prospects for the second quarter darkened after the nation’s consumer confidence index dropped more-than-expected to a level of 94.2 in April, from a reading of 96.2 in the previous month and against investor expectations for a fall to a level of 96.0.

On the other hand, the US preliminary Markit services PMI rose to a level of 52.1 in April, compared to a reading of 51.3 in the prior month. Markets were anticipating the index to climb to a level of 52.0.

In other economic news, the US S&P/Case-Shiller composite home price index (HPI) of 20 metropolitan areas in the US rose 5.4% YoY in February, lower than market expectations for a rise of 5.5%. In the previous month, the index had climbed by a revised 5.7%. Additionally, the Richmond Fed manufacturing index declined to a level of 14.0 in April, from a reading of 22.0 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1303, with the EUR trading marginally higher from yesterday’s close.

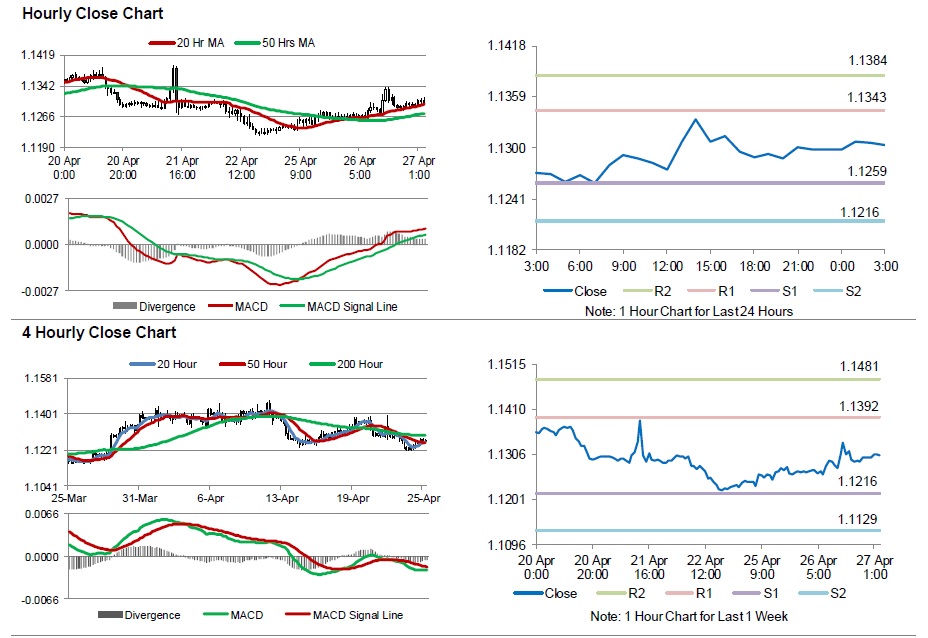

The pair is expected to find support at 1.1259, and a fall through could take it to the next support level of 1.1216. The pair is expected to find its first resistance at 1.1343, and a rise through could take it to the next resistance level of 1.1384.

Going ahead, investors will look forward to Germany’s Gfk consumer confidence index data for May, scheduled to release in a few hours. Additionally, market participants will also have their sights set on the US Federal Reserve’s (Fed) interest rate decision, due to be announced later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.