For the 24 hours to 23:00 GMT, the EUR rose 0.36% against the USD and closed at 1.0760.

In economic news, Germany’s wholesale price index fell 0.4% MoM in October, after registering a drop of 0.6% in the previous month.

In the US data showed that mortgage applications fell for the third consecutive week. The US MBA mortgage applications declined 1.3% in the week ended 06 November, after recording a fall of 0.8% in the previous week.

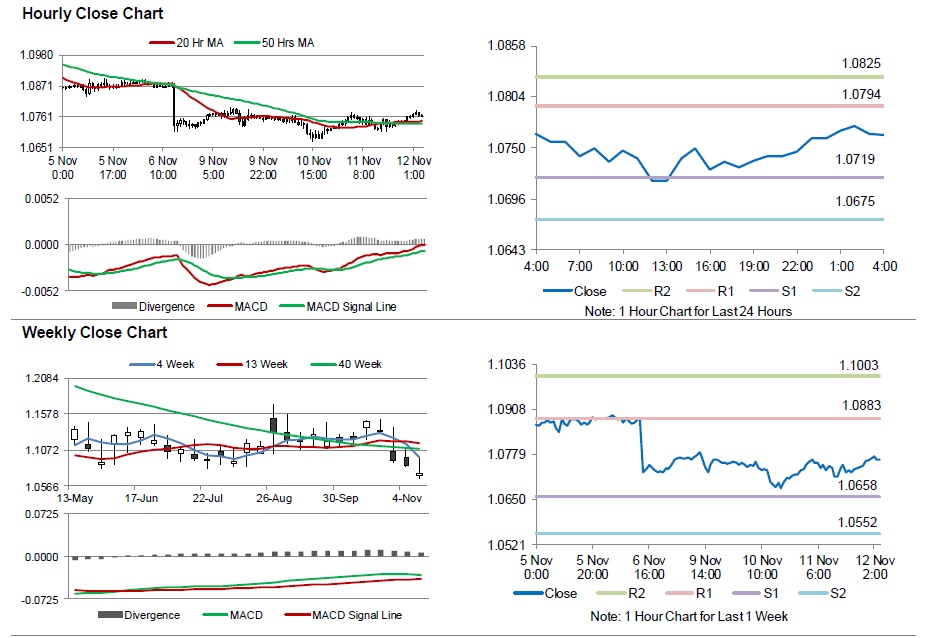

In the Asian session, at GMT0400, the pair is trading at 1.0763, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0719, and a fall through could take it to the next support level of 1.0675. The pair is expected to find its first resistance at 1.0794, and a rise through could take it to the next resistance level of 1.0825.

Moving ahead, market participants will concentrate on Germany’s consumer price inflation and the Euro-zone’s industrial production data, scheduled to be released in a few hours. Additionally, the US initial jobless claims and monthly budget statement, scheduled to be released later in the day, will garner market attention. Moreover, the Federal Reserve Chairperson, Janet Yellen’s speech, due later today, will be scrutinized by investors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.