For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.0633.

Macroeconomic data showed that Eurozone’s preliminary Markit manufacturing PMI surprisingly rose to a level of 52.8 in November, registering its 14-month high level, and up from a reading of 52.3 in the previous month. Investors had expected it to remain unchanged. At the same time, the region’s services index notched a 54-month high level of 54.6, defying expectations for it to remain unchanged at 54.1. Elsewhere in Germany, the manufacturing and services sector performed much better than anticipated in November. Germany’s preliminary Markit manufacturing PMI rose to level of 52.6 in November, reaching its 3-month high level, and compared to a reading of 52.1 in the previous month. The nation’s services PMI notched a 14-month high level of 55.6, during the same period, after registering a reading of 54.5 in the prior month.

Separately, ECB’s Executive Board member, Sabine Lautenschlaeger, indicated that the central bank should not extend its bond-buying programme any further and that the Euro-zone area has so far shown itself to be resilient to uncertainty in the global economy.

In the US, the Chicago Fed national activity index registered a rise to -0.04, in October, compared to a revised level of -0.29 in the previous month. Markets were expecting it to advance to a level of 0.08. However, the nation’s flash Markit manufacturing PMI sank to a two-year low level of 52.6 in November, compared to market expectations of a fall to 54.0, and after recording a reading of 54.1 in the previous month. Also, the US existing home sales eased unexpectedly by 3.4% MoM to a level of 5.36 million, compared to market expectations of a fall to 5.4 million, and after registering a reading of 5.6 million in the previous month.

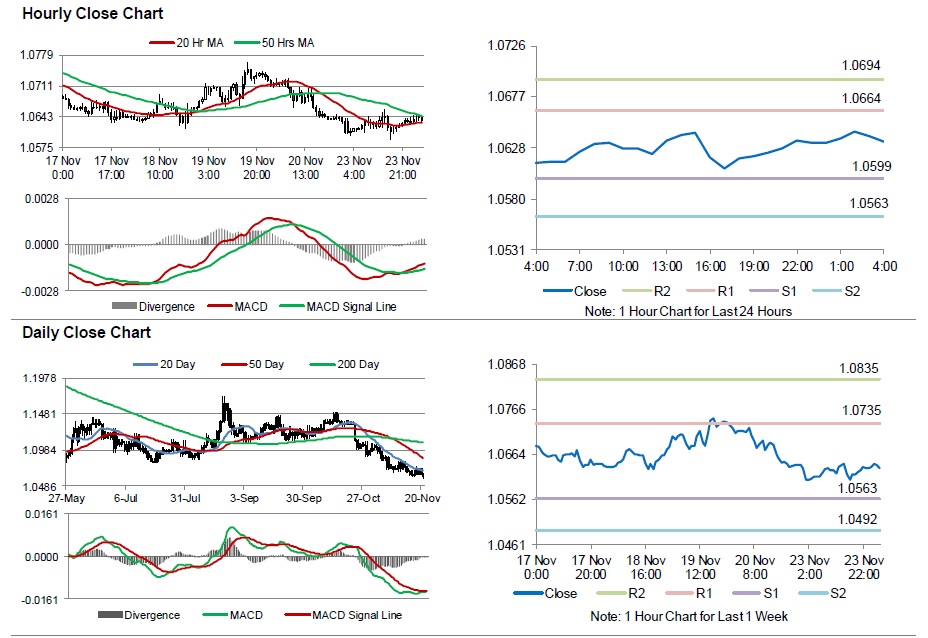

In the Asian session, at GMT0400, the pair is trading at 1.0634, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0599, and a fall through could take it to the next support level of 1.0563. The pair is expected to find its first resistance at 1.0664, and a rise through could take it to the next resistance level of 1.0694.

Going ahead, market participants will keep a close watch on Germany’s Q3 GDP data, scheduled to be released in a few hours. Additionally, investors will also look forward to the US Q3 GDP data and consumer confidence data for November, due later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.