For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1389.

In economic news, the Euro-zone’s Sentix investor confidence index rose less-than-expected to a level of 5.7 in April, from a reading of 5.5 in the previous month, suggesting that it failed to benefit from the additional stimulus injected by the ECB. Investors had expected it to advance to a level of 7.0. Additionally, producer prices in the region slid 0.7% MoM in February, more than market expectations for a fall of 0.5%. In the prior month, it had registered a revised drop of 1.1%. On the other hand, Euro-zone’s unemployment rate fell in line with investor expectations to a level of 10.3% in February, its lowest since August 2011, following a revised reading of 10.4% in the previous month.

Separately, the ECB’s Executive Board member, Peter Praet, warned that low inflation in the Euro-zone might become persistent which in turn will prove damaging to the economy. Further, he indicated that the central bank will act “forcefully” to raise inflation, if needed.

The greenback gained ground, after the Boston Fed President, Eric Rosengren, indicated that the Fed is likely to hike interest rates earlier than the markets expect, given the resilience of the US economy. Additionally, he also stated that he expects inflation will rise gradually

In other economic news, US factory orders declined 1.7% in February, following a revised rise of 1.2% in the previous month. Further, final durable goods orders in the nation fell more-than-expected by 3.0% in February, higher than market expectations for a drop of 2.8%. The preliminary figure had recorded a drop of 2.8%.

In the Asian session, at GMT0300, the pair is trading at 1.1395, with the EUR trading marginally higher from yesterday’s close.

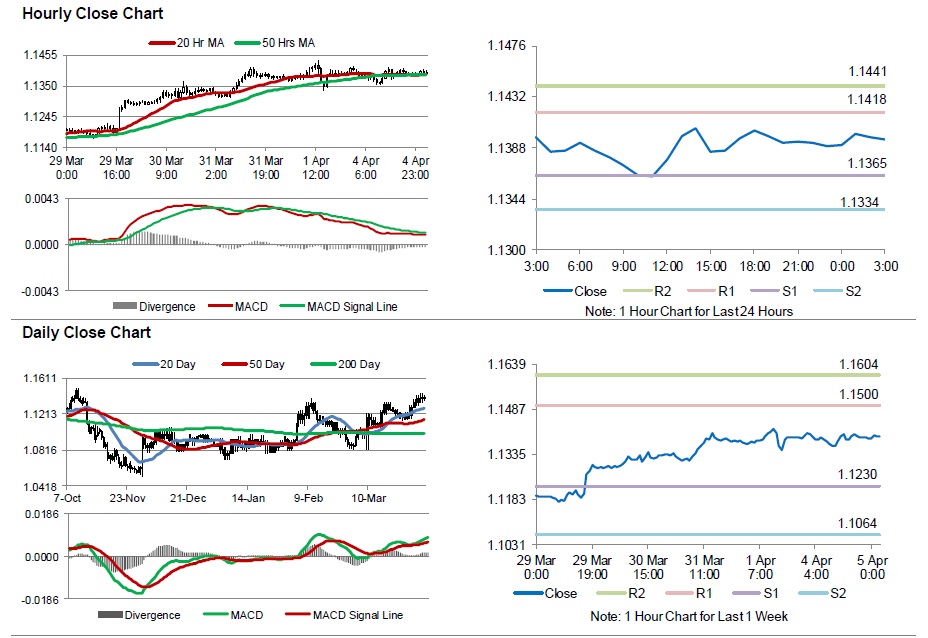

The pair is expected to find support at 1.1365, and a fall through could take it to the next support level of 1.1334. The pair is expected to find its first resistance at 1.1418, and a rise through could take it to the next resistance level of 1.1441.

Going ahead, investors will look forward to the release of Markit services PMI data for March, across the Euro-zone, along with the Euro-zone’s retail sales data for February. Moreover, the US trade balance, Markit services PMI and the ISM non-manufacturing PMI, will also garner significant amount of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.