For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.0928.

In economic news, private sector loans in the Eurozone rose 1.4% YoY in November, following a rise of 1.2% in the previous month. On the other hand, Italy’s producer price index declined further by 0.5% MoM in November, after falling by 0.2% in the prior month.

In the US, pending home sales surprisingly fell for the third time in four months by 0.9% MoM in November, compared to market expectations for an advance of 0.7% and following a revised rise of 0.4% in the previous month.

Separately, the International Monetary Fund (IMF) Chief, Christine Lagarde, warned that global economic growth will be disappointing in 2016 and that the outlook for the medium-term has also deteriorated, with rising US interest rates, Chinese slowdown and disappointing world trade contributing to global economic uncertainty.

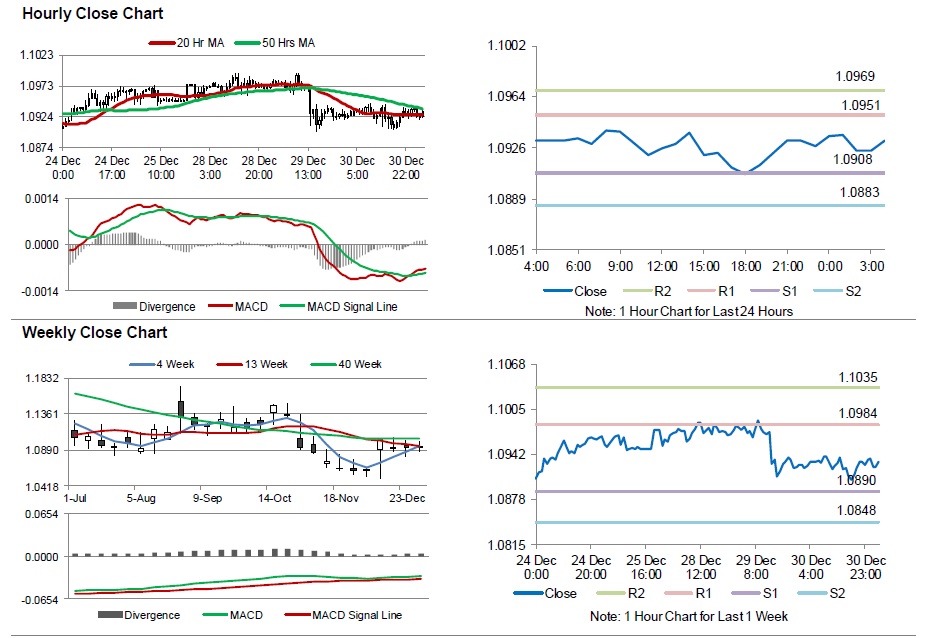

In the Asian session, at GMT0400, the pair is trading at 1.0932, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0908, and a fall through could take it to the next support level of 1.0883. The pair is expected to find its first resistance at 1.0951, and a rise through could take it to the next resistance level of 1.0969.

Moving ahead, market participants await the ECB’s monetary policy meeting accounts, scheduled to release later today. Moreover, the US initial jobless claims and Chicago purchasing managers index, due later in the day, will also attract a lot of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.