For the 24 hours to 23:00 GMT, EUR declined marginally against the USD and closed at 1.3811.

The US Dollar advanced after an official report showed that annual consumer inflation rate in the US rose more-than-expected to 1.5% in March, fuelling optimism on the recovery prospects of the world’s largest economy. However, the US NAHB housing market index came in below market expectations for April while the New York Fed’s “Empire State” general business conditions index fell this month to the lowest level since November.

Meanwhile, the Boston Fed President, Eric Rosengren opined that the central bank should adopt a more specific guidance on its interest rates, by stating that the US Fed “could promise to keep short-term interest rates at very low levels until the economy is within one year of reaching full employment and 2% inflation.” Separately, the Fed Chief, Janet Yellen hinted that the central was considering further steps to force big banks to hold more capital in order to withstand periods of financial stress.

The Euro lost ground after Germany’s economic sentiment fell for the fourth straight month to a reading of 43.2 this month. Meanwhile, the common currency continued to be under pressure as concerns rose that Ukraine would fall into a protracted civil war. However, losses were pared to some extent after the ZEW’s index on Euro-zone’s economic sentiment declined less-than-expected in April and the region’s trade surplus on a non-seasonally adjusted monthly basis widened more than economists’ expectations to €13.6 billion in February. Additionally, the ZEW reported that its index on Germany’s current situation climbed more than forecast for the fifth straight month in April.

In the Asian session, at GMT0300, the pair is trading at 1.3816, with the EUR trading marginally higher from yesterday’s close.

Early morning, Minneapolis Fed President, Narayana Kocherlakota urged the central bank to do more to get the US inflation and unemployment rate to return to healthier levels, which according to him, could possibly remain below the Fed’s goal for several more years.

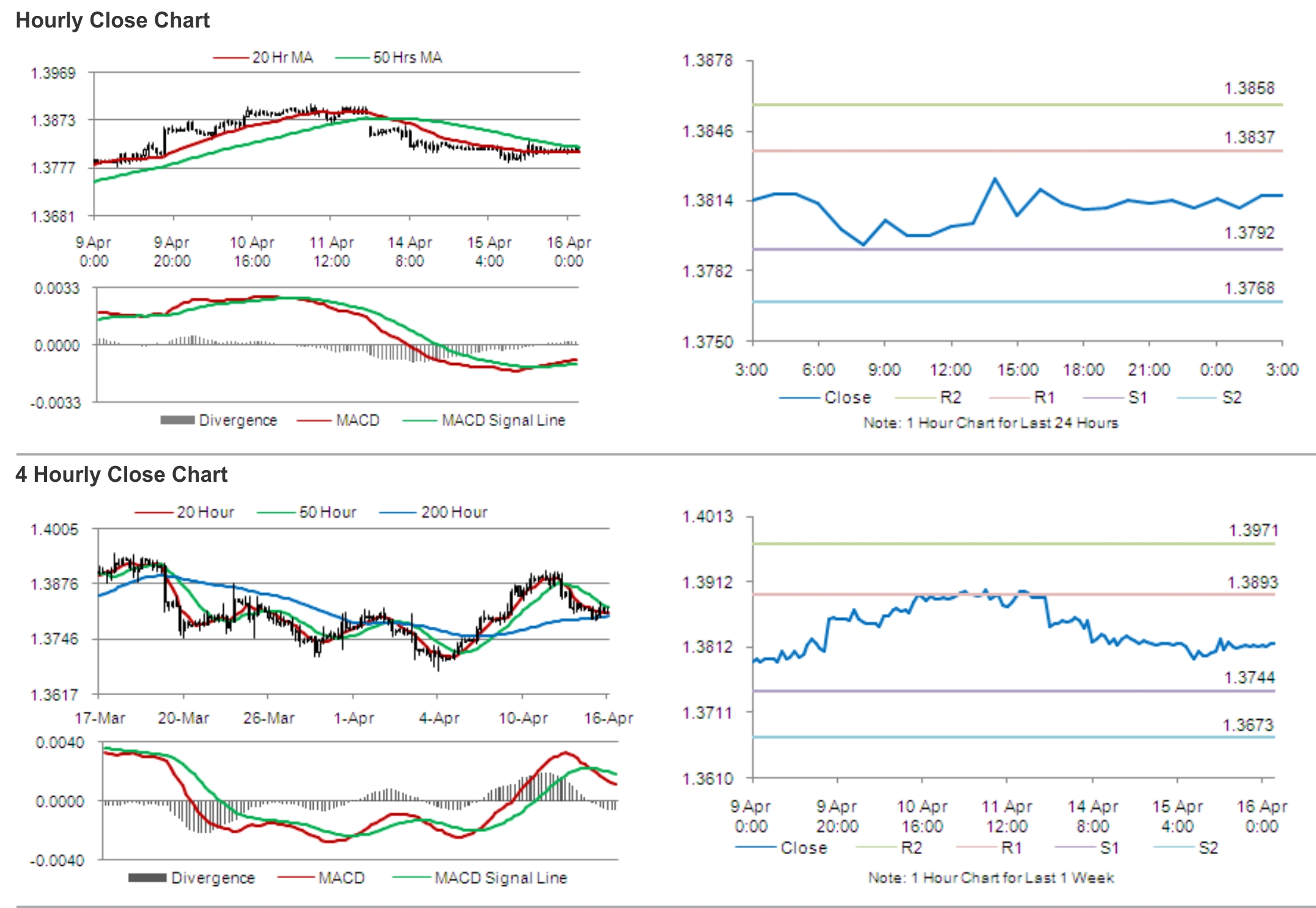

The pair is expected to find support at 1.3792, and a fall through could take it to the next support level of 1.3768. The pair is expected to find its first resistance at 1.3837, and a rise through could take it to the next resistance level of 1.3858.

Traders keenly await the release of the Euro-zone’s consumer inflation data, which is widely expected to rise on a monthly basis. Meanwhile, the building permits and housing starts data from the US would provide guidance on the health of the housing market in the nation.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.