For the 24 hours to 23:00 GMT, the EUR rose 0.51% against the USD and closed at 1.0624, following the release of upbeat Eurozone economic data.

German unemployment rate unexpectedly dropped to 6.3%, in November, its lowest level in 24 years, reinforcing expectations that robust domestic demand will continue to bolster growth in Eurozone’s largest economy. Investors had expected it to remain unchanged at 6.4%. At the same time, unemployment rate in the Eurozone fell for the second straight month to 10.7% in October, notching its lowest level in nearly four years, compared to a reading of 10.8% in the previous month. Markets were expecting the unemployment rate to record a steady reading.

Further, the final German manufacturing PMI rose to a level of 52.9 in November, higher than market expectations of a rise to a level of 52.6. The preliminary figures had indicated an advance to 52.6, while in the previous month it had recorded a reading of 52.1. Moreover, the final manufacturing PMI in the Eurozone climbed to 52.8, in line with market expectations. The preliminary figures had also recorded a rise to 52.8, after recording a reading of 52.3 in the previous month.

The greenback lost ground after a weaker-than-expected economic data fuelled concerns about the health of the US economy. Data showed that the final Markit manufacturing PMI eased to 52.8 in November, compared to market expectations of a fall to 52.6. The preliminary figures had recorded a drop to 52.6. In the previous month, it had recorded a reading of 54.1. Additionally, the nation’s ISM manufacturing activity index surprisingly declined for the first time in three years to a level of 48.6 in November, compared to a reading of 50.1 in the previous month, and against market expectations for it to rise to a level of 50.5. On the other hand, construction spending in the US rose 1.0% MoM in October, touching a 8-year high, higher than market expectations of it to remain steady at 0.6%.

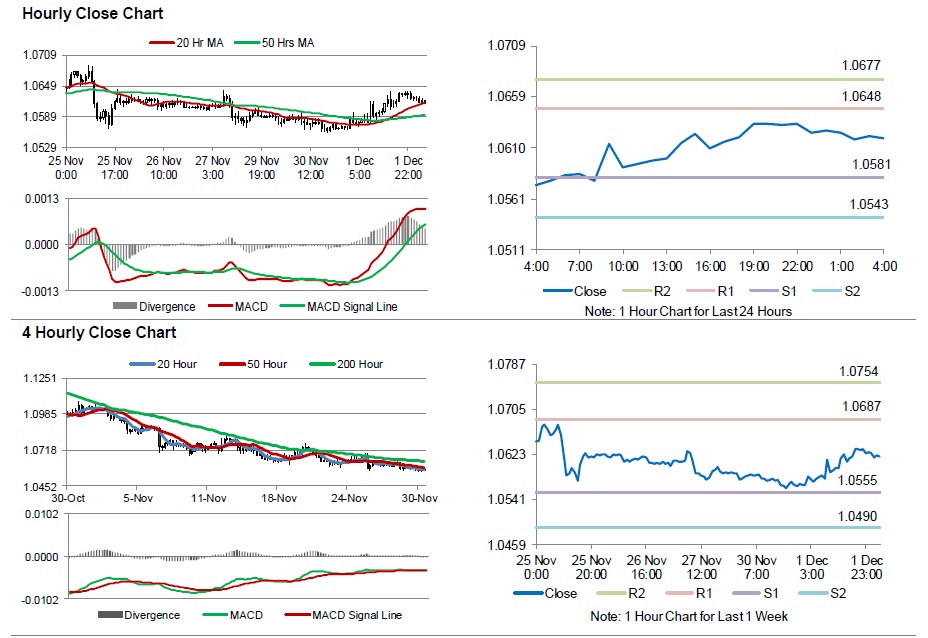

In the Asian session, at GMT0400, the pair is trading at 1.0619, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0581, and a fall through could take it to the next support level of 1.0543. The pair is expected to find its first resistance at 1.0648, and a rise through could take it to the next resistance level of 1.0677.

Moving ahead, investors would concentrate on Euro-zone’s consumer price inflation data for November, scheduled to be released in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.