For the 24 hours to 23:00 GMT, the EUR rose 1.58% against the USD and closed at 1.1095.

In economic news, the final print of the Euro-zone’s final Markit services PMI remained steady at 53.6 in January, in line with market expectations. Moreover, Euro-zone’s retail sales rebounded for the first time in 4 months by 0.3% MoM in December, at par with market expectations and compared to a fall of 0.3% in the preceding month. On the other hand, Germany’s final Markit services PMI unexpectedly fell to a level of 55.0 in January while markets expected it to remain steady at 55.4.

The greenback lost ground, after the release of dismal US service sector data and dovish comments made by a top Fed official.

Yesterday, data showed that the US ISM non-manufacturing PMI declined more-than-expected to a near two-year low level of 53.5 in January, from 55.8 in the previous month and lower than market expectations for a fall to a level of 55.1. Further, the New York Fed President, William Dudley, hinted that the recent global market turmoil might adversely affect the US growth outlook which in turn could prompt the central bank to delay its next interest-rate hike.

In other economic news, the final Markit services PMI surprisingly declined to a level of 53.2 in January, hitting its lowest level since October 2013, thus further indicating that economic growth slowed in the country. Meanwhile, investors expected it to remain steady at 53.7. Additionally, the nation’s mortgage applications fell for the first time in 4-weeks by 2.6% in the week ended 29 January, from a gain of 8.8% in the previous week. On the other hand, the nation’s ADP employment data showed that the number of people employed increased more than anticipated by 205.0K in January, following a revised reading of 267.0K in the preceding month, pointing toward the nation’s resilient jobs market despite market turmoil.

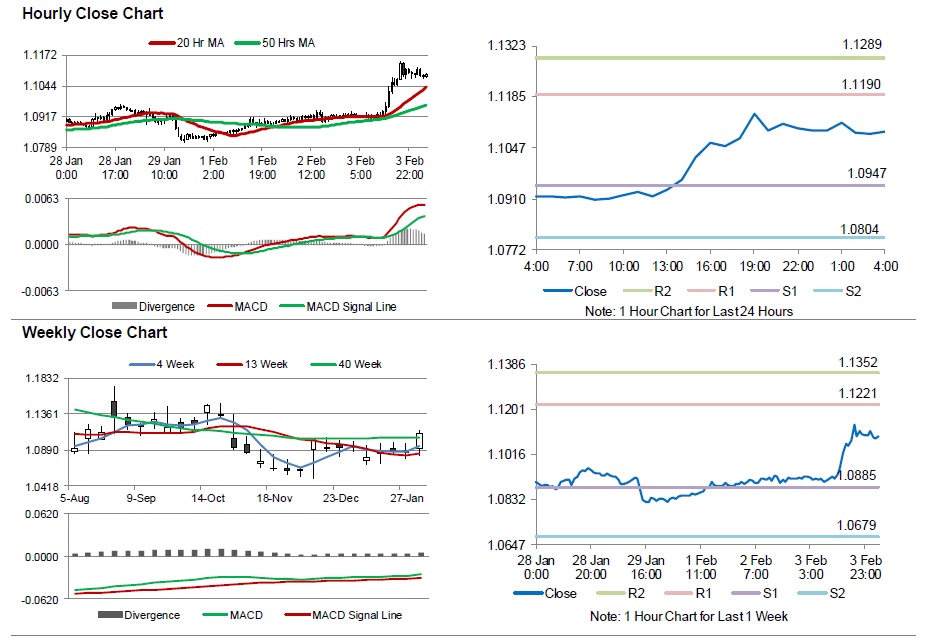

In the Asian session, at GMT0400, the pair is trading at 1.1091, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0947, and a fall through could take it to the next support level of 1.0804. The pair is expected to find its first resistance at 1.119, and a rise through could take it to the next resistance level of 1.1289.

Moving ahead, investors will look forward to Germany’s construction PMI data, scheduled to be released in a few hours. Additionally, the US initial jobless claims and factory orders data, due later in the day, will attract a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.