For the 24 hours to 23:00 GMT, the EUR traded flat against the USD and closed at 1.1404.

In economic news, Germany’s construction PMI declined to a five-month low level of 53.4 in April, mainly led by a sharp drop in commercial and civil engineering sub-sectors and compared to a reading of 55.8 in the previous month.

In the US, non-farm payrolls rose less-than-expected by 160.0K in April, its smallest gain since September, raising expectations that the Federal Reserve (Fed) would hike interest rates at a very slow pace. Market expectations were for an advance of 200.0K, after registering a gain of 215.0K in the previous month. Meanwhile, unemployment rate remained steady at 5.0% in April, compared to investor expectations of a drop to 4.9%. However, there was a bright spot in the jobs report as average hourly earnings climbed 2.5% in April, in the US, higher than market expectations for a rise of 2.4%. In the prior month, average hourly earnings of all employees had advanced by 2.3%.

In other economic news, US consumer credit advanced by $29.7 billion in March, more than market expectations for an advance of $16.0 billion. In the previous month, consumer credit had advanced by a revised $14.15 billion.

Separately, the New York Fed President, William Dudley, indicated that two interest rate hikes this year was still a “reasonable expectation.”

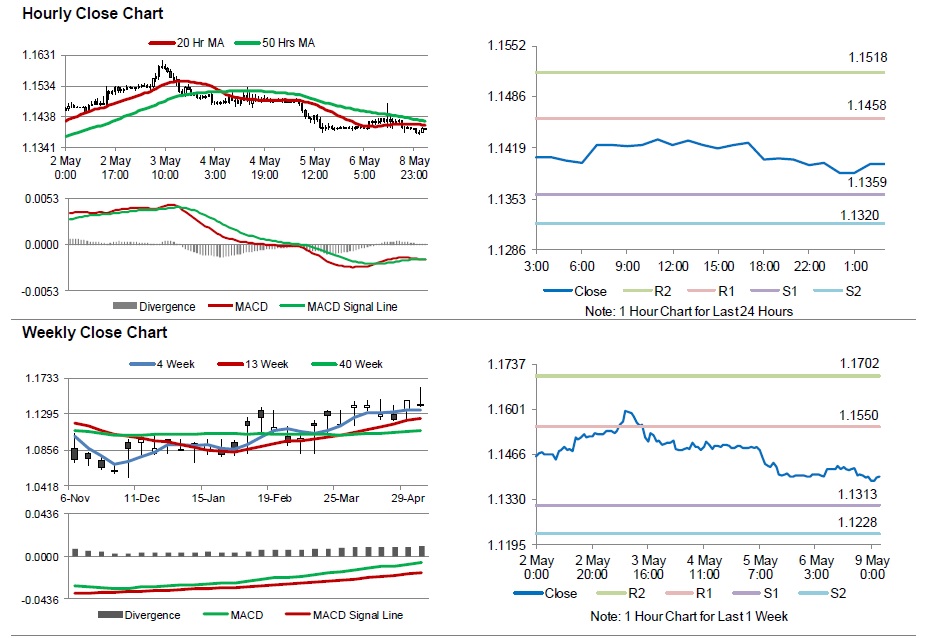

In the Asian session, at GMT0300, the pair is trading at 1.1398, with the EUR trading marginally lower from Friday’s close.

The pair is expected to find support at 1.1359, and a fall through could take it to the next support level of 1.1320. The pair is expected to find its first resistance at 1.1458, and a rise through could take it to the next resistance level of 1.1518.

Going ahead, investors will look forward to the Eurozone Sentix investor confidence index data for May and Germany’s factory orders data for March, scheduled to release in a few hours. Moreover, the US labour market conditions index data, due later today, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.